DIY Home Improvement Market Analysis by Mordor Intelligence

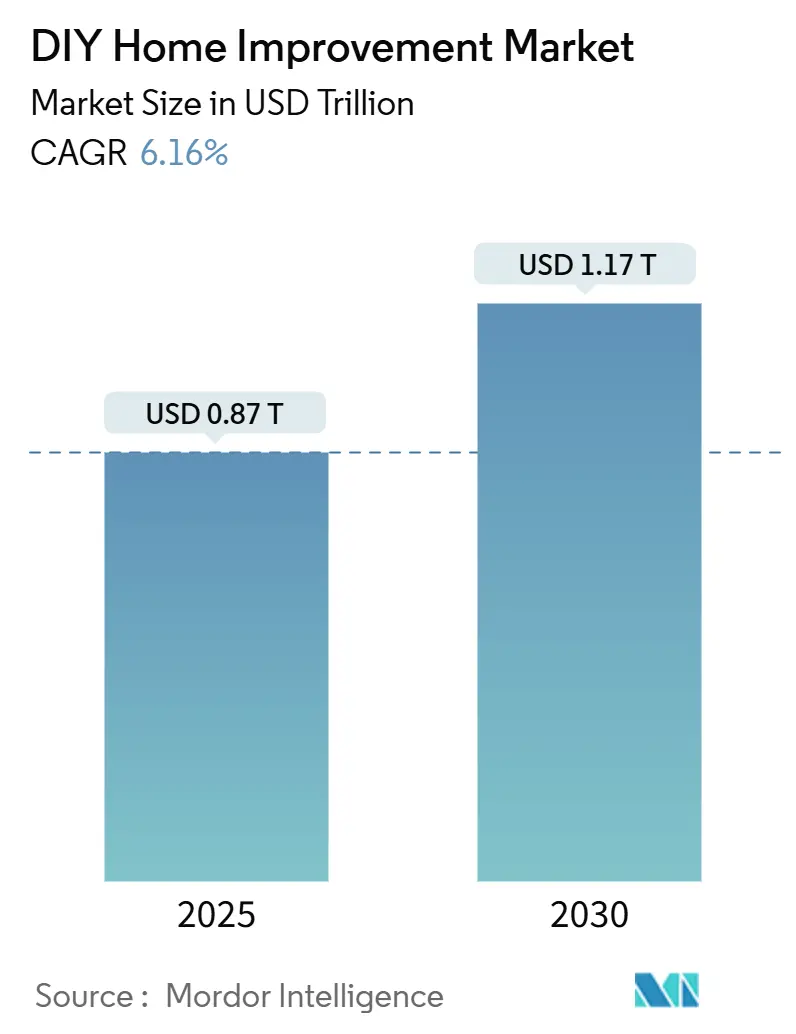

The DIY home improvement market reached USD 0.87 trillion in 2024 and is on track to attain USD 1.17 trillion by 2030, advancing at a 6.16% CAGR during 2025-2030. Growth continues as aging housing stock prompts replacement cycles, millennials and Gen Z embrace renovation as a lifestyle choice, and retailers merge physical expertise with digital convenience. E-commerce penetration, immersive visualization tools, and expanding tool-sharing platforms lower project barriers, while material innovation accelerates aesthetic upgrades. North America remains the revenue leader, helped by a well-established retail infrastructure, whereas Asia-Pacific records the fastest growth as rising middle-class homeowners adopt Western-style DIY projects. Competitive strategies hinge on mega-acquisitions that deepen professional-contractor reach, balanced by investments in augmented-reality (AR) and marketplace models to widen assortments and personalize shopping journeys. Despite lumber volatility and skilled-trade shortages, the DIY home improvement market displays resilience because consumers pivot to do-it-yourself solutions and retailers counter cost headwinds with supply-chain diversification and price-lock guarantees.

Key Report Takeaways

By product type, Building Materials held 52.13% of DIY home improvement market share in 2024, whereas flooring and tiles is projected to expand at an 8.29% CAGR through 2030.

By distribution channel, home-improvement/DIY stores led with 72.36% revenue share in 2024, while online pure-play retail registers the highest forecast CAGR of 9.19% during 2025-2030 in the DIY home improvement market.

By project type, interior remodel accounted for 43.69% of DIY home improvement market size in 2024, whereas outdoor living is advancing at an 8.08% CAGR through 2030.

By region, North America retained 44.11% revenue share in 2024; Asia-Pacific is the fastest-growing region at 9.71% CAGR to 2030 in the DIY home improvement market.

The Home Depot Inc., Lowe’s Companies Inc., ADEO Group, Kingfisher plc and Menards Inc. together controlled the majority of industry revenue in 2024.

Global DIY Home Improvement Market Trends and Insights

Drivers Impact Analysis

| Driver | (~) % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| E-commerce and omnichannel access to DIY supplies | +1.2% | Global, with North America & Europe leading adoption | Medium term (2-4 years) |

| Millennial and Gen-Z home-ownership driven remodeling | +1.8% | North America & APAC core, spill-over to Europe | Long term (≥ 4 years) |

| Aging housing stock in N. America and Europe | +1.5% | North America & Europe primarily | Long term (≥ 4 years) |

| Social-media influencer culture fuelling DIY projects | +0.9% | Global, with stronger impact in urban markets | Short term (≤ 2 years) |

| Maker-space and tool-sharing economy expansion (under-radar) | +0.6% | North America & Europe, expanding to APAC urban centers | Medium term (2-4 years) |

| AR-based project-planning apps boosting confidence (under-radar) | +0.7% | Global, with early adoption in North America & APAC | Medium term (2-4 years) |

Source: Mordor Intelligence

E-commerce and Omnichannel Access to DIY Supplies

Online transactions now account for 29% of all DIY purchases, and hardware represents more than half of those online sales[1]Source: Home Depot, “2025 Fact Sheet,” homedepot.com . Retailers answer with immersive design platforms such as Lowe’s Style Studio for Apple Vision Pro that let shoppers visualize kitchen remodels before buying[2]Source: Lowe’s, “Style Studio for Apple Vision Pro,” lowes.com. Seamless inventory visibility, buy-online-pickup-in-store options, and AI-powered voice search shorten purchase paths and increase basket sizes. Younger homeowners, who conduct exhaustive digital research, reward retailers that combine transparent pricing, detailed product data, and quick last-mile delivery. Consequently, the DIY home improvement market benefits from shoppers who fluidly pivot between channels to compare prices, obtain tutorials, and secure project materials in a single journey.

Millennial and Gen-Z Home-ownership Driven Remodeling

Millennials allocate significant budgets, 1 in 5 spends more than USD 5,000 annually on upgrades, despite lower accumulated equity compared with older cohorts. Gen Z sustains the pipeline: 57% are open to purchasing fixer-uppers, and many choose renovation over relocation because elevated mortgage rates encourage staying put. Energy efficiency and smart-home functionality top priority lists, prompting demand for connected thermostats, high-efficiency HVAC systems, and integrated lighting controls. Younger demographics also remodel rental units, underscoring a mindset that values immediate comfort and style over long-term capital returns. This sustained appetite anchors long-run volume for the DIY home improvement market.

Aging Housing Stock in North America and Europe

Median US home age stands at 39 years, driving systematic replacement cycles for HVAC, roofing, electrical, and plumbing systems. European housing stock confronts similar obsolescence, layered with heritage-preservation mandates that complicate upgrades. Extreme weather events linked to climate change accelerate exterior repairs and resilience improvements. The aging stock phenomenon particularly benefits replacement-focused segments, with replacement projects accounting for 50% of remodeling spending, up from 40% two decades ago, indicating sustained structural demand independent of economic cycles.

Social-media Influencer Culture Fueling DIY Projects

Visual platforms elevate design trends overnight, inspiring homeowners to try bold colors, retro tiles, and sustainable materials showcased by influencers. Video tutorials on YouTube and TikTok demystify complex steps, while affiliate marketing links seamlessly steer viewers to product pages. Retailers and manufacturers respond by creating share-worthy “how-to” content and partnering with creators for product launches, fostering spikes in demand for niche items such as peel-and-stick wall panels. Social media thereby amplifies both project frequency and product diversity, reinforcing the relevance of the DIY home improvement market among digitally native consumers.

Restraints Impact Analysis

| Restraint | (~) % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Skilled-trade shortages shifting projects to DIFM | -1.1% | Global, with acute impact in North America & Europe | Medium term (2-4 years) |

| Volatile lumber and raw-material prices | -0.8% | Global, with North America most affected by tariffs | Short term (≤ 2 years) |

| Complex local permitting for structural DIY work | -0.5% | North America & Europe, varying by jurisdiction | Long term (≥ 4 years) |

| Insurance exclusions on owner-done structural changes (under-radar) | -0.4% | North America & Europe primarily | Medium term (2-4 years) |

Source: Mordor Intelligence

Skilled-trade Shortages Shifting Projects to DIFM

Wage inflation lifts average HVAC-technician pay above USD 50,000, raising project costs that push homeowners toward do-it-for-myself solutions. Contractors combat gaps with AI-enabled estimating tools and expanded apprenticeship programs, yet onboarding lags demand. Retailers step in by offering installation services via gig-economy platforms, bridging capability gaps for complex tasks while preserving DIY enthusiasm for smaller jobs. The talent crunch, therefore, suppresses large remodel volumes but simultaneously nudges prospective customers into the DIY home improvement market for manageable projects.

Volatile Lumber and Raw-material Prices

Western Spruce-Pine-Fir climbed 21% year-over-year in 2025 to USD 545 per thousand board feet. Tariff uncertainty, US duties on Canadian softwood could rise from 14.5% to 34.5%, magnifies price swings. Homeowners delay major additions or shift budgets to smaller interior refreshes to hedge against surprises, while builders trim contingencies and diversify supplier bases. Retailers pilot price-lock programs to stabilize demand, yet margin management remains challenging. Though volatility briefly dampens volume, substitution with engineered wood, metal framing, or composite decking mutes long-term damage, sustaining the fundamental momentum of the DIY home improvement market.

Segment Analysis

By Product Type: Building Materials Anchor Market Foundation

Building Materials generated 52.13% of the DIY home improvement market size in 2024, underscoring their indispensability for structural upkeep and foundational work. Paints and Coatings maintain steady relevance by aligning with color-cycle fashions and protective performance gains. Tools and Equipment capture incremental growth as ergonomic designs and battery-platform interoperability attract female renovators and aging do-it-yourselfers. Plumbing and Electrical components benefit from code-driven efficiency retrofits, particularly in older housing where systemic upgrades become unavoidable. Flooring and Tiles record the segment’s fastest 8.29% CAGR as luxury vinyl plank, click-lock hardwood, and recycled-content ceramic tiles satisfy both aesthetic and sustainability goals.

Consumer preferences now favor lower-VOC paints, recycled aggregates, and FSC-certified lumber, nudging suppliers toward green certifications that differentiate shelf space. Roofing and siding adopt polymer-modified composites for extended warranties, while insulation integrates phase-change materials to moderate indoor temperatures. Smart-integrated products, such as Wi-Fi-enabled circuit breakers or moisture-sensing subfloors, unlock data-driven maintenance opportunities. Because replacement-oriented lines deliver predictable demand regardless of discretionary sentiment, Building Materials continue to anchor revenue even as décor-centric categories collect media buzz. The DIY home improvement industry thus evolves through a blend of utilitarian necessity and design-led aspiration.

Note: Segment shares of all individual segments available upon report purchase

By Distribution Channel: Traditional Dominance Meets Digital Disruption

Home-Improvement/DIY Stores supplied 72.36% of sector revenue in 2024, relying on expert staff, project-bundled merchandising, and same-day product availability. Store associates wield mobile-POS devices to locate aisle inventory, generate quotes, and schedule truck rentals, reinforcing role as consultative hubs. Big-box footprints host tool-rental centers and drive-through lumber yards that entice pros and seasoned renovators, validating brick-and-mortar relevance within the DIY home improvement market.

Online Pure-play Retail, however, scales quickly at a 9.19% CAGR thanks to limitless SKU depth, algorithmic recommendations, and doorstep delivery within 48 hours. Marketplace extensions add third-party offerings—Kingfisher’s Polish banner now lists 500,000 items—without capital-intensive store expansion. Consumers migrate seamlessly: 36% prefer hybrid purchase journeys that research online and transact in store or vice versa. Mass-Merchandisers capture convenience buys across paint touch-ups and seasonal décor, while Specialty Stores thrive on technical expertise for categories such as plumbing, fasteners, or electrical components. The strategic imperative is thus not channel selection but capability fusion, as click-and-collect penetration rises and warehouse aisles double as micro-fulfillment nodes in the wider DIY home improvement market.

Note: Segment shares of all individual segments available upon report purchase

By Project Type: Interior Focus Shifts to Outdoor Expansion

Interior Remodel projects retained 43.69% revenue share in 2024, with kitchens averaging USD 35,000 and bathrooms USD 17,000 per job. Home chefs chase pro-style ranges, quartz countertops, and touch-free faucets, while bath upgrades add curbless showers and anti-fog mirrors. Yet post-pandemic behavior pivots attention outdoors: decks, pergolas, and fire-pit patios propel Outdoor Living to an 8.08% CAGR. Composite decking that eliminates seasonal staining lowers lifetime costs, enticing novice adopters into the DIY home improvement market.

Systems Upgrade tasks accelerate as aging HVAC units, dated breaker panels, and galvanized plumbing reach end-of-life. Electrification trends linked to EV adoption and induction cooking require amperage boosts, sparking demand for load-center replacements. Exterior refreshes—siding, windows, roofing—advance curb appeal and energy savings, supported by local incentives that cut payback periods to under five years. Project-type diversity thus mitigates cyclical risk and widens participation across skill levels, budgets, and climatic zones.

Geography Analysis

DIY Home Improvement Market in Latin America

North America contributed 44.11% of total revenue in 2024, grounded in mature DIY culture, an aging housing base, and a deeply penetrated retail network of 4,000+ big-box stores. The United States drives volume as tax incentives for energy-efficient upgrades and rising insurance premiums for storm-resilient materials redirect spending from discretionary goods toward durable improvements. Canada leverages abundant timber resources for competitive building-material pricing, while Mexico’s middle-class expansion draws US retailers southward. Lumber tariffs remain a headwind, yet retailers offset risk by contracting broader supplier pools and launching price-protection programs. Skilled-trade shortages raise contractor quotes, pushing simpler tasks into the DIY home improvement market even as labor bottlenecks limit large-scale remodel throughput.

Asia-Pacific posts the fastest 9.71% CAGR through 2030, lifted by urbanization and income growth. China’s tier-2 and tier-3 cities see apartment refurbishment as a status marker, India’s government-backed housing programs expand homeownership, and Southeast Asian consumers embrace small-space makeovers guided by social media tutorials. Regional leaders scale aggressively: Mr. DIY operates 4,000+ stores across eight markets and serves 188 million customers annually, proving that low-price, breadth-of-range strategies resonate widely. Australia’s Bunnings commands loyalty through weekend community workshops that educate novices. Labor shortages in Japan temper complex renovation growth, but demographic aging also spurs demand for accessibility retrofits, feeding incremental revenue into the DIY home improvement market.

Europe exhibits heterogeneous growth. Western nations such as Germany and France mature slowly, yet policy-driven energy-renovation subsidies provide a steady baseline. Eastern Europe registers faster expansion thanks to rising disposable income and accelerating housing-quality convergence. Kingfisher restructures French chains while rolling out a 500,000-SKU marketplace in Poland to capture online momentum[3]Source: Kingfisher plc, “FY 2024 Results Presentation,” kingfisher.com. ADEO Group, Europe’s largest home improvement retailer, reports EUR 24.2 billion turnover in 2024, with 94% sustainably sourced wood reflecting heightened consumer eco-awareness. Diverse building codes and permit regimes complicate product standardization, requiring modular assortments tailored to country-specific regulations. Nonetheless, decarbonization mandates and heritage-preservation grants secure long-term demand for efficient glazing, insulation, and low-VOC finishes within Europe’s slice of the DIY home improvement market.

Competitive Landscape

Innovation and Digital Integration Drive Success

Success in the DIY home improvement market increasingly depends on companies' ability to integrate digital technologies while maintaining a strong physical retail presence. Incumbents must focus on developing comprehensive omnichannel strategies, investing in customer experience technologies, and building robust supply chain networks to maintain their market position. The ability to offer personalized solutions through data analytics, provide seamless online-to-offline experiences, and maintain efficient inventory management systems has become crucial for market leadership. Companies must also focus on sustainability initiatives and eco-friendly product offerings to align with changing consumer preferences.

For contenders looking to gain market share, differentiation through specialized product offerings, superior customer service, and innovative digital solutions presents significant opportunities. The market shows relatively low substitution risk due to the essential nature of home improvement products, but companies must stay vigilant about changing consumer preferences and emerging alternatives. Success factors include developing strong private label programs, building efficient logistics networks, and creating engaging customer experiences through both digital and physical channels. While regulatory requirements regarding product safety and environmental standards continue to evolve, they present opportunities for companies to differentiate themselves through compliance excellence and sustainable practices. The role of suppliers in the home improvement industry is crucial in this ecosystem, providing the necessary materials and technologies to support these innovations.

DIY Home Improvement Industry Leaders

-

The Home Depot

-

Lowe’s Companies Inc

-

ADEO Group

-

Kingfisher plc

-

Menards Inc.

- *Disclaimer: Major Players sorted in no particular order

Recent Industry Developments

- June 2025: Home Depot enters a bidding contest with QXO for GMS Inc., eyeing expanded distribution capacity and faster last-mile delivery networks.

- April 2025: Lowe’s finalizes the USD 1.325 billion Artisan Design Group acquisition, adding design-build services for single-family and multifamily interiors.

- March 2025: James Hardie acquires The AZEK Company for USD 8.75 billion, forming a composite-materials platform in a USD 23 billion North American exterior-products market.

- January 2025: Kingfisher launches a 500,000-SKU marketplace on Castorama Poland, broadening customer choice beyond its 50,000-item core range.

Global DIY Home Improvement Market Report Scope

"Do it yourself" (DIY) refers to creating, altering, or fixing something without the support of specialists or professionals. The report includes a thorough background analysis of the DIY home improvement market, which consists of the evaluation of the economy and the contribution of its various sectors, a market overview, an estimate of the market size for important market segments, and emerging trends within those segments, market dynamics and insights, and important statistics. The market is segmented by product type (lumber and landscape management, decor and indoor garden, kitchen, painting and wallpaper, tools and hardware, building materials, lighting, plumbing and equipment, flooring, repair and replacement, and electrical work), distribution channel (DIY home improvement stores, specialty stores, online, and furniture), and geography (North America, South America, Europe, Asia-Pacific, and the Middle East and Africa). The report offers market size and forecasts for the global DIY home improvement market in value in USD for all the above segments.

| By Product Type | Building Materials | ||

| Paints and Coatings | |||

| Tools and Equipment | |||

| Decor and Lighting | |||

| Flooring and Tiles | |||

| Plumbing and Electrical | |||

| By Distribution Channel | Home-Improvement / DIY Stores | ||

| Online Pure-play Retail | |||

| Mass-Merchandisers and Grocery | |||

| Specialty Stores and Others | |||

| By Project Type | Interior Remodel | ||

| Exterior / Curb Appeal | |||

| Systems Upgrade (HVAC, Electrical, Plumbing) | |||

| Outdoor Living | |||

| By Region | North America | Canada | |

| United States | |||

| Mexico | |||

| South America | Brazil | ||

| Peru | |||

| Chile | |||

| Argentina | |||

| Rest of South America | |||

| Asia-Pacific | India | ||

| China | |||

| Japan | |||

| Australia | |||

| South Korea | |||

| South East Asia (Singapore, Malaysia, Thailand, Indonesia, Vietnam, and Philippines) | |||

| Rest of Asia-Pacific | |||

| Europe | United Kingdom | ||

| Germany | |||

| France | |||

| Spain | |||

| Italy | |||

| BENELUX (Belgium, Netherlands, and Luxembourg) | |||

| NORDICS (Denmark, Finland, Iceland, Norway, and Sweden) | |||

| Rest of Europe | |||

| Middle East and Africa | United Arab Emirates | ||

| Saudi Arabia | |||

| South Africa | |||

| Nigeria | |||

| Rest of Middle East and Africa | |||

| Building Materials |

| Paints and Coatings |

| Tools and Equipment |

| Decor and Lighting |

| Flooring and Tiles |

| Plumbing and Electrical |

| Home-Improvement / DIY Stores |

| Online Pure-play Retail |

| Mass-Merchandisers and Grocery |

| Specialty Stores and Others |

| Interior Remodel |

| Exterior / Curb Appeal |

| Systems Upgrade (HVAC, Electrical, Plumbing) |

| Outdoor Living |

| North America | Canada |

| United States | |

| Mexico | |

| South America | Brazil |

| Peru | |

| Chile | |

| Argentina | |

| Rest of South America | |

| Asia-Pacific | India |

| China | |

| Japan | |

| Australia | |

| South Korea | |

| South East Asia (Singapore, Malaysia, Thailand, Indonesia, Vietnam, and Philippines) | |

| Rest of Asia-Pacific | |

| Europe | United Kingdom |

| Germany | |

| France | |

| Spain | |

| Italy | |

| BENELUX (Belgium, Netherlands, and Luxembourg) | |

| NORDICS (Denmark, Finland, Iceland, Norway, and Sweden) | |

| Rest of Europe | |

| Middle East and Africa | United Arab Emirates |

| Saudi Arabia | |

| South Africa | |

| Nigeria | |

| Rest of Middle East and Africa |

Key Questions Answered in the Report

What is the current DIY Home Improvement Market size?

In 2025, the DIY home improvement market size is expected to reach USD 0.87 trillion.

Which region is growing fastest in the DIY home improvement market?

Asia-Pacific leads with a 9.71% CAGR through 2030, dur to urbanization and rising middle-class incomes.

Which product category holds the largest DIY home improvement market share?

Building materials dominate with 52.13% share, reflecting their necessity across all project types.

How are online channels influencing the DIY home improvement market?

Online pure-play retail is expanding at a 9.19% CAGR as shoppers value extensive assortments, fast delivery, and AR visualization tools.

What are the major headwinds facing the DIY home improvement market?

Skilled-trade shortages, volatile lumber prices, and complex permitting processes collectively dampen growth, though they also redirect many homeowners to do-it-yourself solutions.

Page last updated on: July 6, 2025