Autonomous Agents Market Size and Share

Autonomous Agents Market Analysis by Mordor Intelligence

The autonomous agents market was valued at USD 4.42 billion in 2025 and is forecast to reach USD 18.25 billion by 2030, registering a CAGR of 32.79% over the period. Rapid enterprise digitalization, rising labor-cost pressures, and expanding AI capabilities are pushing autonomous agents beyond pilot projects into core business workflows. Companies are deploying software agents to streamline customer service, optimize networks, orchestrate complex workflows, and deliver analytics-driven decisions. Large language models linked with domain-specific data are widening the scope of tasks that agents can handle, while advances in cloud infrastructure reduce the compute barriers that once limited real-time agent execution. Regulatory clarity in key markets and increasing confidence in agent governance are further accelerating commercial rollout.

Key Report Takeaways

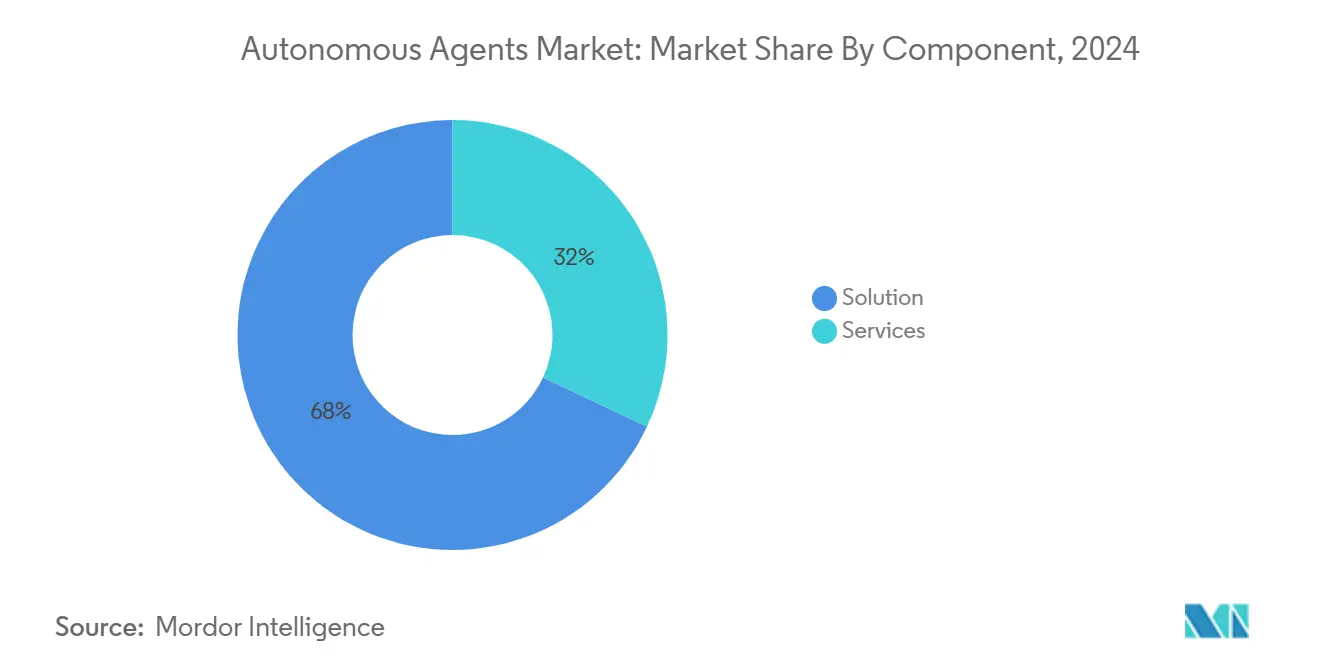

- By component, Solutions led with 68% revenue share in 2024 while Services is projected to advance at a 34.8% CAGR through 2030, reflecting rising demand for integration, training, and managed-service expertise.

- By deployment model, Cloud captured 82% of the autonomous agents market share in 2024; it is forecast to post the fastest 34.9% CAGR to 2030 as enterprises scale compute-intensive large-language-model workloads.

- By autonomy level, Reactive agents remain the largest installed base, yet Cognitive agents are the quickest climbers, improving decision accuracy by 35% and driving the highest growth rate through 2030.

- By organization size, Large enterprises accounted for 70% of market revenue in 2024, whereas SMEs are set to expand at a 33.5% CAGR thanks to no-code platforms and AI-as-a-Service pricing that lower entry barriers.

- By industry vertical, IT and Telecom held 30% of the autonomous agents market size in 2024; Healthcare and Life Sciences is projected to surge at a 37.8% CAGR between 2025-2030 as providers automate clinical and administrative workflows.

- By geography, North America led with a 41% revenue share in 2024, while Asia Pacific is poised to grow at a 36.3% CAGR through 2030 on the back of aggressive smart-factory and 5G edge-agent deployments

Global Autonomous Agents Market Trends and Insights

Drivers Impact Analysis

| Driver | ( ~ ) % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Hyper-personalised customer engagement in BFSI | 7.40% | Global, led by North America and Europe | Medium term (2-4 years) |

| European automotive shift to software-defined vehicles | 5.80% | Europe, spillover to North America | Medium term (2-4 years) |

| Multi-agent RL for smart-factory optimisation | 6.20% | Asia Pacific, chiefly China, Japan, South Korea | Short term (≤ 2 years) |

| Regulatory mandates for explainable AI in US federal agencies | 4.50% | North America | Long term (≥ 4 years) |

Source: Mordor Intelligence

Hyper-personalised Customer Engagement Needs in BFSI Driving Agent Adoption

Banks are rolling out autonomous agents to deliver real-time, personalised recommendations across digital channels, with 78% of global institutions scheduling deployments by 2026. JPMorgan’s COIN platform now reviews 12,000 complex contracts a year, saving 360,000 human hours and raising accuracy by 30%. Integration with core banking systems lets agents make instant lending and fraud-monitoring decisions, turning reactive service into proactive engagement. Return on investment is strengthened by service-delivery savings of 25–30% and customer-satisfaction gains of 15–20%. Regulatory frameworks in the United States and the European Union are maturing, allowing agents to handle sensitive transactions with clear audit trails. These factors together are adding a 7.4% lift to the autonomous agents market CAGR.

European Automotive OEM Shift to In-Vehicle Software-Defined Architectures

Manufacturers are redesigning vehicles around software platforms that embed agents throughout the driving experience. Mercedes-Benz is integrating agents within MB.OS to adapt to driver habits and road conditions, boosting predictive-maintenance capability and cutting downtime by 20%.[1]Siemens, “Mercedes-Benz MB.OS and Industrial AI Agents,” siemens.com The movement from hardware to software differentiation is opening space for secure, scalable agent ecosystems that comply with Europe’s strict privacy rules. Increased software R&D, now growing more than 35% each year among leading OEMs, underlies the 5.8% CAGR impact.

Surge in Multi-agent RL for Smart-Factory Optimisation in North Asia

Factories in Japan, South Korea, and China are adopting collaborative reinforcement-learning agents that drive 15–25% productivity gains over traditional automation. Samsung’s semiconductor lines achieved a 35% defect reduction and 12% throughput gain after multi-agent rollouts. Government incentives and acute labor shortages make deployment quick, placing the impact in the short-term window and adding 6.2% to market growth.

Regulatory Mandates for Explainable AI in U.S. Federal Agencies

The National Institute of Standards and Technology AI Risk Management Framework obliges federal systems to provide clear audit trails. The Department of Defense has budgeted USD 1.2 billion for explainable AI in 2025, fuelling demand for agents that can translate reasoning into human-readable form. Vendor investments in explainability layers are building competitive edges and adding 4.5% to the growth outlook over the long term.

Restraints Impact Analysis

| Restraint | ( ~ ) % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Lack of interoperability standards | -3.20% | Global | Medium term (2-4 years) |

| Talent scarcity in multi-agent safety and alignment engineering | -3.90% | Global, acute in North America and Europe | Short term (≤ 2 years) |

Source: Mordor Intelligence

Lack of Interoperability Standards Across Heterogeneous Agent Platforms

Enterprises report cross-platform integration delays averaging 8.3 months, limiting multi-agent collaboration benefits. Only 23% of deployments manage to connect agents from more than one vendor, forcing lock-in or expensive custom work. Vendors pursuing common protocols, such as Google’s Agent2Agent, have yet to reach critical mass, restraining near-term adoption by 3.2%.

Talent Scarcity in Multi-Agent Safety and Alignment Engineering

Seventy-one percent of organizations cite skills gaps as the top barrier to autonomous agent projects. Advanced safety testing, reinforcement-learning oversight, and alignment tuning demand scarce expertise, delaying rollouts and trimming CAGR by 3.9%. Specialized training programs are expanding, yet the pipeline will take time to meet demand.

Segment Analysis

By Component: Solutions Dominate While Services Accelerate

Solutions captured 68% of the autonomous agents market in 2024, showing enterprise preference for ready-made platforms that integrate security, governance, and workflow orchestration. IBM watsonx Orchestrate links to more than 80 business applications and lists over 150 pre-built agents in its catalog.[2] IBM, “Cognitive Agent Performance Benchmark,” ibm.com The segment benefits from quick implementation and unified management consoles, making it the cornerstone of large-scale deployments. Services, however, are expanding quickly as firms seek consulting for complex rollouts. A 34.8% CAGR through 2030 indicates that integration, training, and managed-services partners are central to unlocking solution value.

Growing adoption complexity is lifting demand for expert guidance. Regulated sectors such as finance and healthcare need advisory services to meet compliance, and managed-services providers are stepping in to operate agents for customers lacking in-house talent. The autonomous agents market size allocated to services is predicted to multiply as enterprises migrate pilot projects into production and request ongoing optimization.

Note: Segment shares of all individual segments available upon report purchase

By Deployment Type: Cloud Dominance Accelerates

Cloud deployments owned 82% share in 2024, reflecting preference for elastic compute that supports large language models. Microsoft Azure AI Foundry gives users access to more than 1,900 AI models and auto-scales resources to match workload demand.[3]Microsoft, “Azure AI Foundry Product Blog,” microsoft.com The cloud’s 34.9% forecast CAGR confirms its role as the default environment, helped by growing confidence in virtual-private-cloud security controls. The autonomous agents market size attributed to cloud workloads is expected to widen further as model-size growth outpaces on-premises capacity.

On-premises systems remain important for defense, government, and financial services that demand control over sensitive data. Hybrid approaches are bridging the gap, routing inference to local infrastructure while training runs in the cloud. Edge computing is emerging as a complementary method where agents run latency-sensitive tasks near devices, blending security with scale.

By Autonomy Level: Cognitive Agents Drive Innovation

Reactive agents still form the largest installed base because rules-based logic is predictable and simple to audit. They handle high-volume tasks such as basic chat support. Deliberative agents, which plan against internal world models, are spreading in sectors that need goal-based reasoning, including insurance underwriting and clinical triage. Cognitive agents are the breakout category. They combine large language models, reinforcement learning, and knowledge graphs to adapt to novel contexts. IBM testing shows cognitive agents reduce decision time by 70% and improve accuracy by 35% compared with scripted automation.

Hybrid agents blend reactive speed with deliberative planning. They suit mission-critical operations where reliability is essential. As specialization deepens, purpose-built cognitive agents for finance, retail, and logistics will expand the autonomous agents market beyond horizontal use cases.

By Organization Size: Large Enterprises Lead, SMEs Accelerate

Large enterprises contributed 70% of 2024 revenue, aided by ample budgets and robust digital infrastructure. Over 100,000 companies now create or refine agents in Microsoft Copilot Studio, many with complex multi-agent ecosystems microsoft.com. Deep integration into ERP, CRM, and supply-chain tools delivers measurable savings and data-driven insights. Small and medium-sized enterprises are closing the gap. A projected 33.5% CAGR shows that no-code platforms and AI-as-a-Service models are lowering entry barriers.

SME adoption focuses on immediate wins such as lead qualification, invoice matching, and HR onboarding. Pay-as-you-go pricing reduces risk, while marketplaces provide vertical templates that shorten deployment cycles. The result is broadening participation that diversifies the autonomous agents industry customer base.

By Industry Vertical: IT and Telecom Leads, Healthcare Accelerates

IT and Telecom held 30% of total revenue in 2024, reinforcing its status as the proving ground for AI agents. Telecom operators report 40–60% reductions in mean-time-to-repair after adopting autonomous network-monitoring agents.[4]Snowflake, “Telecom Operator Outcomes with Autonomous Monitoring,” snowflake.com IT service teams now rely on agents that self-heal infrastructure and triage tickets, freeing staff for higher-value work. Healthcare and Life Sciences is the fastest mover. A 37.8% CAGR through 2030 reflects mounting pressure to control costs and improve patient outcomes. Wipro introduced specialized healthcare agents that automate provider onboarding and insurance verification.

Clinical decision-support agents integrate with electronic health records, enabling personalized treatment plans. Pharmaceutical researchers employ agents to scan literature and design experiments. Privacy regulations remain strict, yet federated learning and synthetic data techniques are opening adoption pathways

Geography Analysis

North America generated 41% of the autonomous agents market in 2024 thanks to heavy R&D investment and early corporate adoption. United States enterprises plan to spend more than USD 300 billion on AI research in 2025, with a sizeable portion aligned to agent technologies. Financial institutions and hospitals lead deployments, boosted by supportive federal frameworks that balance innovation with responsible AI. Concentrated venture funding and deep talent pools add further momentum.

Asia Pacific is the fastest-growing region, forecast to record a 36.3% CAGR between 2025 and 2030. China’s national AI strategy directs significant subsidies toward autonomous manufacturing agents, while Japan and South Korea back smart-factory pilots to address labor shortages. The Gulf region is attracting bespoke agent solutions, and joint ventures such as CNTXT AI and Beam AI estimate a regional market value of USD 4.2–5.4 billion in 2025. Scalable cloud infrastructure and 5G rollouts make the region conducive to edge-deployed agents, expanding scope in logistics and retail.

Europe combines strong ethics oversight with practical deployment in automotive, finance, and industrial settings. The EU AI Act requires transparency and risk management, guiding product design toward trustworthy outcomes. Software-defined architectures in vehicles place Europe at the forefront of in-car agents. The regional AI market could hit USD 235.5 billion by 2031 at a 26.3% CAGR, illustrating robust potential. Data sovereignty rules in healthcare slow adoption but also catalyze advances in privacy-preserving AI that may turn into exportable strengths.

Competitive Landscape

The autonomous agents market is moderately concentrated around four large cloud and AI providers. Microsoft integrates Copilot across Azure, Dynamics 365, and M365, embedding agents into productivity suites and developer tools. Google pushes interoperability through its Agent2Agent protocol that aims to connect heterogeneous agent ecosystems. IBM emphasizes workflow orchestration with watsonx Orchestrate and holds 1,591 AI-related patents secured in 2024, many improving human-agent collaboration. AWS leverages its extensive cloud services catalog to give customers pre-built agents for common operational needs.

Specialists are carving out vertical niches. Salesforce’s Agentforce focuses on customer-centric automation, Oracle’s AI Agent Studio augments back-office processes, and ServiceNow deploys telecom-specific agents for network operations. Start-ups such as Fetch.ai in decentralized networks and Affectiva in emotion inference showcase innovation diversity. Partnerships and marketplaces are becoming decisive, with Siemens planning an industrial AI agent marketplace on the Xcelerator platform and Manhattan Associates launching Agent Foundry to let retailers build custom logistics agents.

Competitive intensity is rising as vendors race to set de facto standards. Security, explainability, and governance features are primary differentiators because they unlock enterprise trust. Vendors that supply both horizontal agent frameworks and specialist domain agents are best positioned to capture incremental spend as customers scale deployments.

Autonomous Agents Industry Leaders

-

IBM Corporation

-

Oracle Corporation

-

SAP SE

-

Amazon Web Services, Inc.

-

SAS Institute Inc.

- *Disclaimer: Major Players sorted in no particular order

Recent Industry Developments

- May 2025: Salesforce acquired Informatica for USD 8 billion to reinforce data management for autonomous agents and strengthen the Agentforce suite.

- May 2025: Microsoft introduced Entra Agent ID and multi-agent support in Copilot Studio to tighten agent identity and delegation governance

- May 2025: Manhattan Associates rolled out Agentic AI with Intelligent Store Manager and Labor Optimizer agents plus the Manhattan Agent Foundry platform

- May 2025: Siemens added advanced AI agents to its Industrial Copilot ecosystem and announced an upcoming marketplace on Siemens Xcelerator

Global Autonomous Agents Market Report Scope

Autonomous agents are software programs that answer to states and events in their context, independent from direct instruction by the user or owner of the agent, but working on behalf and in the owner's interest. The term agent is not specified precisely, and agent software can vary from simple programs comprising a small number of rules to open and sophisticated systems. Agent technology was developed in artificial intelligence (AI) research and can include complex AI techniques.

| By Component | Solution | ||

| - Platforms | |||

| - Frameworks and Toolkits | |||

| Services | |||

| - Professional Services | |||

| - Managed Services | |||

| By Deployment Type | Cloud | ||

| On-Premises | |||

| By Autonomy Level | Reactive Agents | ||

| Deliberative Agents | |||

| Hybrid Agents | |||

| Cognitive Agents | |||

| By Organization Size | Small and Medium-sized Enterprises (SMEs) | ||

| Large Enterprises | |||

| By Industry Vertical | BFSI | ||

| IT and Telecom | |||

| Healthcare and Life Sciences | |||

| Manufacturing | |||

| Transportation and Mobility | |||

| Retail and E-commerce | |||

| Energy and Utilities | |||

| Others | |||

| By Geography | North America | United States | |

| Canada | |||

| South America | Brazil | ||

| Rest of South America | |||

| Europe | Germany | ||

| United Kingdom | |||

| France | |||

| Nordics | |||

| Rest of Europe | |||

| Middle East | GCC | ||

| Turkey | |||

| Rest of Middle East | |||

| Africa | South Africa | ||

| Rest of Africa | |||

| Asia Pacific | China | ||

| Japan | |||

| South Korea | |||

| India | |||

| Rest of Asia | |||

| Solution |

| - Platforms |

| - Frameworks and Toolkits |

| Services |

| - Professional Services |

| - Managed Services |

| Cloud |

| On-Premises |

| Reactive Agents |

| Deliberative Agents |

| Hybrid Agents |

| Cognitive Agents |

| Small and Medium-sized Enterprises (SMEs) |

| Large Enterprises |

| BFSI |

| IT and Telecom |

| Healthcare and Life Sciences |

| Manufacturing |

| Transportation and Mobility |

| Retail and E-commerce |

| Energy and Utilities |

| Others |

| North America | United States |

| Canada | |

| South America | Brazil |

| Rest of South America | |

| Europe | Germany |

| United Kingdom | |

| France | |

| Nordics | |

| Rest of Europe | |

| Middle East | GCC |

| Turkey | |

| Rest of Middle East | |

| Africa | South Africa |

| Rest of Africa | |

| Asia Pacific | China |

| Japan | |

| South Korea | |

| India | |

| Rest of Asia |

Key Questions Answered in the Report

What is the current size of the autonomous agents market?

The market was valued at USD 4.42 billion in 2025 and is set to grow rapidly through 2030.

Which component segment dominates revenue?

Solution platforms held 68% market share in 2024, reflecting demand for turnkey agent frameworks.

Why is healthcare the fastest-growing vertical?

Healthcare agents cut administrative burdens and aid clinical decisions, driving a 37.8% CAGR outlook under stringent cost-control pressures.

How important is cloud deployment for autonomous agents?

Cloud accounts for 82% of deployments thanks to its elastic compute capacity and expansive AI model libraries.

What are the biggest hurdles to adoption?

Talent shortages in safety engineering and the absence of interoperability standards delay projects and add integration costs.

Which region will grow fastest by 2030?

Asia Pacific is forecast to expand at a 36.3% CAGR due to strong government backing, smart-factory initiatives, and 5G edge infrastructure.

Page last updated on: July 7, 2025