Reactive Diluents Market Size and Share

Reactive Diluents Market Analysis by Mordor Intelligence

The Reactive Diluents Market size is estimated at USD 1.05 billion in 2025, and is expected to reach USD 1.40 billion by 2030, at a CAGR of 5.89% during the forecast period (2025-2030). Growing demand for low-viscosity epoxy systems that comply with tightening VOC rules anchors this steady advance. Increased wind-energy investments, wider uptake of UV-curable printing resins, and continuous infrastructure upgrades provide strong volume pull, while formulators benefit from the dual function of reactive diluents as both processing aids and performance modifiers. Cost pressure from volatile bisphenol-A and epichlorohydrin feedstocks accelerates the search for bio-based glycidyl ethers that match incumbent performance. Producers able to balance compliant chemistry with supply security are winning contracts in aerospace coatings, industrial composites, and 3-D printing photopolymers.

Key Report Takeaways

- By diluent type, aliphatic grades led with 40.24% of reactive diluents market share in 2024; bio-based grades are poised for the fastest 6.66% CAGR to 2030.

- By application, paints and coatings accounted for 46.45% of the reactive diluents market size in 2024, whereas 3-D printing resins are on track for a 6.34% CAGR through 2030.

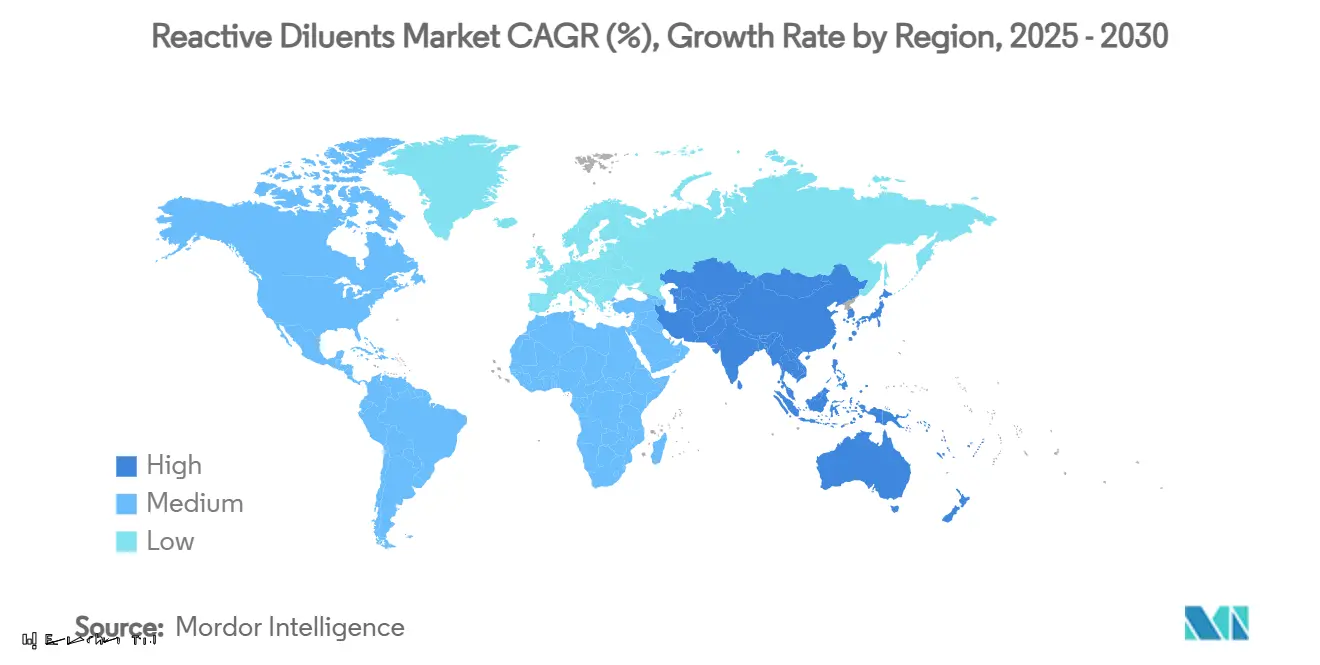

- By geography, Asia Pacific captured 45.45% revenue share in 2024, and the region is forecast to expand at a 6.97% CAGR to 2030.

Global Reactive Diluents Market Trends and Insights

Driver Impact Analysis

| Driver | (~) % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Shift to low-VOC industrial coatings | +1.2% | Global, with strongest impact in North America & EU | Medium term (2-4 years) |

| Rapid expansion of wind-blade composites | +0.9% | APAC core, spill-over to North America & EU | Long term (≥ 4 years) |

| Infrastructure rehabilitation epoxy flooring | +0.7% | Global, concentrated in developed markets | Medium term (2-4 years) |

| Adoption of UV-curable 3-D printing resins | +0.8% | North America & EU, expanding to APAC | Short term (≤ 2 years) |

| Emergence of bio-based glycerol/glycidyl ethers | +0.6% | EU leading, followed by North America | Long term (≥ 4 years) |

Source: Mordor Intelligence

Shift to Low-VOC Industrial Coatings

EPA amendments that took effect in January 2025 cap allowable VOCs in aerosol and industrial coatings, compelling formulators to adopt high-solids epoxy blends enabled by low-viscosity reactive diluents[1]Environmental Protection Agency, “National VOC Emission Standards for Aerosol Coatings: Final Rule,” epa.gov . South Coast AQMD limits in California already require VOC levels under 250 g/l for clear topcoats, and many multinational paint makers now standardize the same formulations globally to streamline compliance[2]South Coast Air Quality Management District, “Rule 1151: Motor Vehicle and Mobile Equipment Non-Assembly Line Coating Operations,” aqmd.gov . Bis-oxazolidine diluents let producers meet those thresholds without sacrificing dry-film hardness. European producers apply similar reformulation tactics to remain within the 420 g/l ceiling of Directive 2004/42/EC. As regulations ratchet up through 2030, supply contracts increasingly specify maximum application viscosity, putting specialty diluent suppliers in a favorable negotiating position.

Infrastructure Rehabilitation Epoxy Flooring

Aging bridges, port terminals, and airport runways increasingly receive thin-film epoxy overlays formulated with reactive diluents that penetrate micro-cracks. Laboratory work with 1,6-hexanediol diglycidyl ether shows viscosity below 40 mPa·s while maintaining LD50 values above 5,000 mg/kg, satisfying performance and safety screens. Studies published in 2024 demonstrated that warm-mix epoxy asphalt with 10% diluent improves rutting resistance by 18% compared with SBS-modified control samples. Such data drive municipal engineering departments to specify reactive-diluent-rich binders in maintenance tenders from 2025 onward.

Adoption of UV-Curable 3-D Printing Resins

Photopolymer printers for dental models and aerospace ducts rely on low-viscosity di-functional diluents like HDDMA to cut layer time and maintain dimensional accuracy within ±0.05 mm. Bio-derived itaconic-acid diluents further improve cure speed without styrene emissions, an advantage when printing in enclosed shop floors. Royal Society of Chemistry findings highlight thiol-ene diluent systems that shrink 40% less during light exposure, improving optical device fabrication. Printer OEMs now benchmark resin kits against these metrics, making diluent chemistry a differentiator in service contracts.

Emergence of Bio-Based Glycerol/Glycidyl Ethers

European climate policy favors renewable monomers, prompting scale-up of glycidyl ethers sourced from epoxidized soybean oil. Academic trials confirm that substituting 30 wt% of conventional DGEBA with cardanol glycidyl ether maintains Tg within 2 °C of baseline while cutting global-warming potential by 35%. Automotive OEMs evaluate these resins for interior trim where odor thresholds are strict. Supply chains remain nascent, yet vertical collaboration between oilseed processors and epoxy formulators signals accelerating commercialization after 2026.

Restraint Impact Analysis

| Restraint | (~) % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Tightening EU REACH/US EPA regulations | -0.8% | EU & North America, cascading globally | Medium term (2-4 years) |

| Volatile bisphenol-A & epichlorohydrin costs | -0.6% | Global, most acute in import-dependent regions | Short term (≤ 2 years) |

| Scale-up hurdles for bio-based alternatives | -0.4% | Global, particularly affecting emerging bio-based suppliers | Long term (≥ 4 years) |

Source: Mordor Intelligence

Tightening EU REACH / US EPA Regulations

Expanded substance evaluations oblige reactive-diluent suppliers to invest in toxicology dossiers that can exceed USD 2 million per substance. The European Commission’s proposed duties on Asian epoxy intermediates further complicate compliance costs by reshaping trade flows, forcing processors to re-qualify new sources. Small and mid-size formulators often lack the capital to file registration updates, leading to market exits and supply tightening.

Volatile Bisphenol-A & Epichlorohydrin Costs

Spot epichlorohydrin prices rose 17% in the first half of 2025 as energy tariffs increased and labor strikes disrupted European chlor-alkali plants. The U.S. Department of Commerce confirmed anti-dumping margins on South Korean epoxy imports, increasing landed costs for North American purchasers. Integrated players absorb some volatility, but independents frequently pass surcharges downstream, pressuring coating makers’ margins and dampening substitution rates for newer diluents.

Segment Analysis

By Reactive Diluent Type: Balancing Aliphatic Dominance with Bio-Based Innovation

Aliphatic grades secured 40.24% of reactive diluents market share in 2024, reflecting entrenched supply chains and low toxicity profiles attractive to flooring and marine coatings. Their share is expected to slip modestly as bio-based entrants grow at a 6.66% CAGR. Aromatic diluents, though higher priced, remain essential in electronics over-molding where elevated Tg offsets solder-reflow stress. Cycloaliphatic variants cater to aerospace and under-the-hood automotive parts that require flexibility at sub-zero temperatures.

The reactive diluents market size for aliphatic grades is set to reach USD 0.56 billion by 2030, expanding 4.1% per year, while bio-based grades could cross USD 0.18 billion by 2030 at the aforementioned 6.66% CAGR. Cardanol-based diluents illustrate the ecological appeal: they lower resin viscosity by 35% yet improve flame-retardancy indexes by 18 units. Research also highlights that dosing 5 phr of carvacrol glycidyl ether can cut VOC output by 22% without altering pot life. Aromatic benzyl glycidyl ether commands price premiums of up to 35% because it lifts heat-deflection temperature by 12 °C in printed-circuit encapsulants. Such property trade-offs shape procurement strategies as OEMs weigh unit cost against lifetime reliability.

Note: Segment shares of all individual segments available upon report purchase

By Application: 3-D Printing Resins Challenge Coating Supremacy

Paints and coatings retained a 46.45% revenue slice in 2024, though their growth moderates to 4.9% annually as legislative ceilings on VOCs encourage waterborne technologies. Additive-manufactured photopolymers, in contrast, show a brisk 6.34% CAGR through 2030 driven by aerospace bracketry, personalized dental aligners, and lightweight UAV components. The reactive diluents market size for 3-D printing is forecast to surpass USD 0.14 billion by 2030, up from USD 0.10 billion in 2025, with di-functional acrylate diluents sustaining layer-on-layer fusion accuracy within ±0.03 mm.

In adhesives and sealants, diluent innovations enable lower-temperature cure cycles that cut energy usage by 12%, a decisive factor in assembly plants targeting carbon neutrality. Epoxy composites for wind blades maintain robust offtake levels, with diluent-enabled RTM resins capturing 33% of new installations in Asia Pacific during 2025. Electrical encapsulation consumes a niche 5% volume but pays premium pricing for high-purity cycloaliphatics that block ionic contamination pathways. Cross-segment synergies arise as UV-curable diluents developed for 3-D printers migrate into PCB solder masks, illustrating technology transfer across industries.

Note: Segment shares of all individual segments available upon report purchase

Geography Analysis

Asia Pacific holds 45.45% of global revenue thanks to expansive chemical production hubs in China, India, and Southeast Asia. Mainland China’s caustic-soda capacity, exceeding 50,000 ktpa in 2024, ensures steady epichlorohydrin supply, letting epoxy formulators price competitively in export markets. India’s specialty-chemicals turnover is projected to reach USD 50 billion in 2025, enlarging the local customer base for reactive diluents in high-growth sectors like wind-energy nacelles and electronic finishes. South Korea and Singapore host regional application labs where multinational suppliers customize low-VOC solutions for tropical climates.

North America, shaped by strict EPA oversight and high adoption of UV-cured paints in automotive refinish shops. Investments in offshore wind along the Atlantic seaboard drive procurement of diluent-tuned infusion resins that withstand cyclic humidity. Federal incentives for advanced manufacturing expand the footprint of resin 3-D printing service bureaus, pushing local consumption of high-purity acrylate diluents.

Europe commands a significant share, yet growth stays below the global mean as REACH compliance costs deter smaller formulators. Nonetheless, EU Green Deal funding supports bio-based chemistry pilots in Germany and the Netherlands. Regulatory stringency positions the region as a testbed for glycerol-derived diluents that surpass 60 % biocarbon content. The Middle East and Africa contribute a modest 6%, but petrochemical diversification programs in Saudi Arabia and the United Arab Emirates include epoxy intermediates that will lift regional self-sufficiency from 2027. South America edges toward 5% market share on the back of Brazilian infrastructure upgrades and wind-farm rollouts in the Patagonia corridor.

Competitive Landscape

The reactive diluents market exhibits moderate concentration. Evonik has redirected capital toward high-growth segments by divesting non-core businesses that generated EUR 350 million in sales in 2024, freeing resources for specialty amine expansions that integrate upstream with its diluents portfolio. Huntsman announced a USD 75 million impairment linked to shutting its Italian maleic-anhydride facility, a step that underscores renewed focus on resin modifiers rather than commodity intermediates.

Arkema leverages its reactive polyamide know-how to supply blade-repair kits that slash downtime by 20% for European wind operators. Emerging firms centered on bio-based chemistry, such as companies commercializing itaconic-acid acrylates, target niche volumes but command 15% price premiums. Established suppliers counter by co-marketing lifecycle-assessment data that prove petro-based grades can still meet stringent ESG criteria when manufactured in energy-efficient plants.

Reactive Diluents Industry Leaders

-

Evonik Industries AG

-

Cargill Inc.

-

Hexion Inc.

-

Huntsman Corporation

-

KUKDO Chemical Co., Ltd.

- *Disclaimer: Major Players sorted in no particular order

Recent Industry Developments

- June 2025: Aditya Birla Group has announced plans to acquire Cargill’s specialty chemicals facility in Dalton, Georgia. The site produces formulated resins, curing agents, reactive diluents, and polyaspartic resins. Aditya Birla Group aims to expand production capacity at the facility within two years while continuing its current product lines.

- September 2023: The ECHA, through its 18th Adaption to Technical Progress (ATP) to CLP (Classification, Labelling and Packaging of substances and mixtures), has revised chemical regulations. Effective December 1, 2023, Trimethylolpropane Triacrylate (TMPTA) will be classified as a Class 2 carcinogen, driving the shift to TMPTA alternatives in UV-curing systems. TMPTA has been a critical component in UV-curing, widely used as a monomer functioning as a reactive diluent.

Global Reactive Diluents Market Report Scope

The reactive diluents market report includes:

| By Reactive Diluent Type | Aliphatic | ||

| Aromatic | |||

| Cycloaliphatic | |||

| Bio-based | |||

| Other Types | |||

| By Application | Paints and Coatings | ||

| Adhesives and Sealants | |||

| Composites | |||

| 3-D Printing Resins | |||

| Others (Electrical Encapsulation) | |||

| By Geography | Asia-Pacific | China | |

| India | |||

| Japan | |||

| South Korea | |||

| Rest of Asia-Pacific | |||

| North America | United States | ||

| Canada | |||

| Mexico | |||

| Europe | Germany | ||

| United Kingdom | |||

| France | |||

| Italy | |||

| Rest of Europe | |||

| South America | Brazil | ||

| Argentina | |||

| Rest of South America | |||

| Rest of Asia-Pacific | |||

| Middle East and Africa | Saudi Arabia | ||

| South Africa | |||

| Rest of Middle East and Africa | |||

| Aliphatic |

| Aromatic |

| Cycloaliphatic |

| Bio-based |

| Other Types |

| Paints and Coatings |

| Adhesives and Sealants |

| Composites |

| 3-D Printing Resins |

| Others (Electrical Encapsulation) |

| Asia-Pacific | China |

| India | |

| Japan | |

| South Korea | |

| Rest of Asia-Pacific | |

| North America | United States |

| Canada | |

| Mexico | |

| Europe | Germany |

| United Kingdom | |

| France | |

| Italy | |

| Rest of Europe | |

| South America | Brazil |

| Argentina | |

| Rest of South America | |

| Rest of Asia-Pacific | |

| Middle East and Africa | Saudi Arabia |

| South Africa | |

| Rest of Middle East and Africa |

Key Questions Answered in the Report

What is the current Reactive Diluents Market size?

The market is valued at USD 1.05 billion in 2025 and is forecast to reach USD 1.40 billion by 2030.

Which region leads the reactive diluents market?

Asia Pacific holds 45.45% of global revenue and is expanding at a 6.97% CAGR to 2030.

What application segment is growing fastest within the reactive diluents market?

3-D printing resins are set to rise at a 6.34% CAGR, outpacing traditional paints and coatings.

How are regulations influencing reactive diluent demand?

Tighter VOC limits in the United States and Europe drive adoption of low-viscosity, high-solids formulations that rely on specialty diluents.

Page last updated on: July 9, 2025