Short Term Vacation Rental Market Size and Share

Short Term Vacation Rental Market Analysis by Mordor Intelligence

The short-term vacation rental market was valued at USD 131.45 billion in 2025 and is forecast to reach USD 222.70 billion by 2030, advancing at an 11.12% CAGR. Demand is lifted by platform consolidation, transparent fee regulation, and host tools that streamline listing management and guest support. Remote work normalization lengthens average stays while artificial-intelligence pricing engines raise occupancy and nightly rates. Recovery in leisure and bleisure travel, together with rising acceptance of alternative lodging across emerging economies, sustains a broad booking pipeline. Competitive intensity is tempered by regulatory standardization that encourages compliance yet raises costs for smaller hosts. These forces combine to keep the short-term vacation rental market on a strong expansion path.

Key Report Takeaways

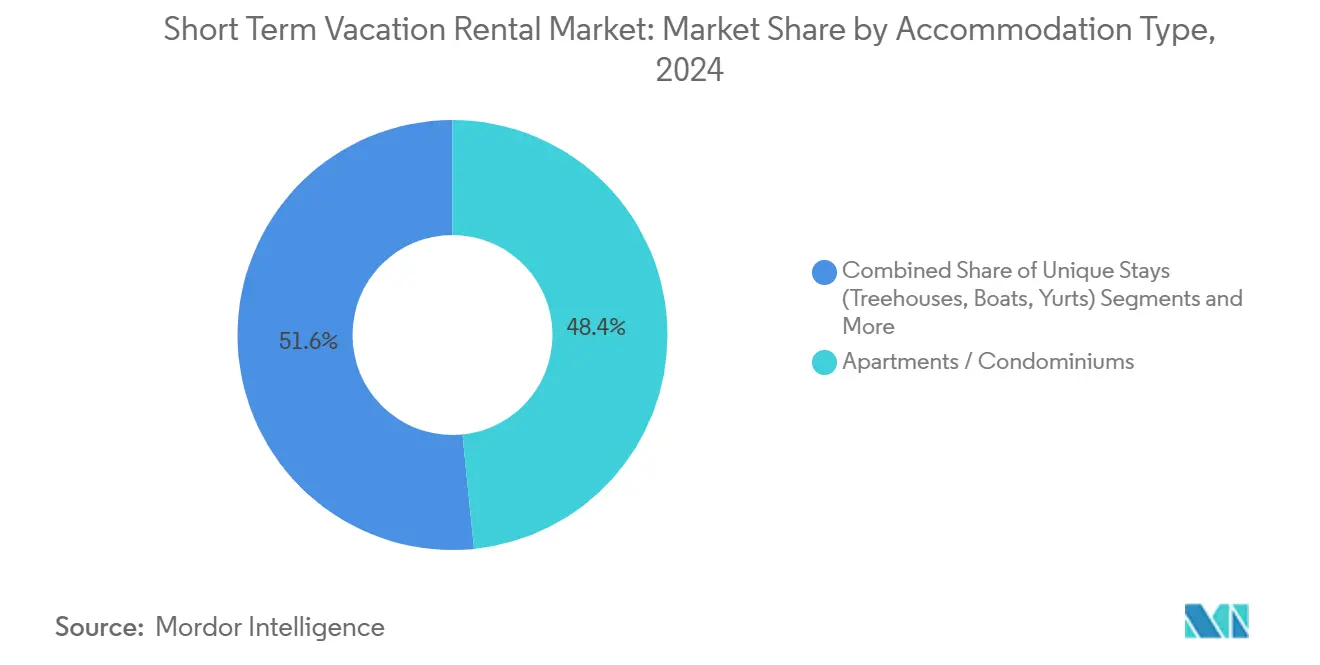

- By accommodation type, apartments and condominiums held 48.38% of the short-term vacation rental market share in 2024, while unique stays are projected to grow at 14.95% CAGR to 2030.

- By booking channel, online travel agencies captured 65.34% revenue in 2024; property-manager platforms record the highest forecast CAGR at 15.13% through 2030 in the short term vacation rental market.

- By guest type, leisure travelers accounted for 44.56% of bookings in 2024, whereas digital nomads and remote workers expanded the fastest at 14.70% CAGR to 2030 in the short-term vacation rental market.

- By geography, North America led with 38.67% revenue share in 2024, yet Asia-Pacific is poised for 14.24% CAGR between 2025 and 2030 in the short-term vacation rental market.

- Top 5 players such as Airbnb, Inc., Booking Holdings Inc. , Expedia Group, Inc., Trip.com Group Ltd., and Vacasa hold major market share in 2024.

Global Short Term Vacation Rental Market Trends and Insights

Drivers Impact Analysis

| Driver | (~) % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Platform-led supply expansion | +2.8% | Global, with strongest impact in North America & Europe | Medium term (2-4 years) |

| Authentic-local experience preference | +2.1% | Global, particularly strong in Asia-Pacific & Latin America | Long term (≥ 4 years) |

| Remote work and digital-nomad stays | +1.9% | North America & EU core, expanding to APAC | Medium term (2-4 years) |

| Post-pandemic tourism rebound | +1.7% | Global, with recovery variations by region | Short term (≤ 2 years) |

| AI-driven dynamic pricing adoption | +1.4% | North America & Europe initially, global expansion | Medium term (2-4 years) |

| City–platform data-sharing pacts | +0.8% | Europe & select North American cities | Long term (≥ 4 years) |

Source: Mordor Intelligence

Platform-led Supply Expansion

Platforms are onboarding hosts at scale through incentive programs, integrated channel managers, and preferred software partnerships that lower listing friction[1]Source: Airbnb Newsroom, “Preferred Software Partners 2025,” airbnb.com. Consolidation of professional property managers under large brand umbrellas standardizes service quality and widens inventory coverage in supply-constrained cities. Automated onboarding, smart-lock integration, and centralized guest messaging cut operating hours for individual owners and accelerate time-to-listing. These efficiencies convert traditional long-term rentals into short term vacation rental market listings, enlarging available units without new construction. Over time, platform ecosystems that tie listing, pricing, and compliance into a single dashboard cement host loyalty and raise switching costs.

Authentic-local Experience Preference

Millennial and Gen Z travelers gravitate toward neighborhood-embedded rentals that promise cultural immersion and walkable access to local cafés and markets. Platforms now surface community-curated activity guides, partner with nearby merchants, and badge homes that retain historic architecture. In return, hosts can command rate premiums that offset tighter occupancy limits in regulated districts. The authenticity push also stimulates demand for heritage homes, artist lofts, and eco-lodges, giving destination marketers new storytelling angles to diversify seasonality.

Remote Work and Digital-Nomad Stays

Hybrid-work policies keep laptops open on the road, turning weekend breaks into multi-week “workcations.” Properties advertising gigabit Wi-Fi, ergonomic desks, and blackout curtains secure longer bookings that smooth revenue volatility. Corporate travel managers are formalizing short-term rentals within duty-of-care frameworks, widening addressable demand beyond freelancers to entire project teams. Secondary cities with lower living costs but stable connectivity, such as Mérida or Chiang Mai, emerge as high-yield clusters in the short term vacation rental market.

Post-pandemic Tourism Rebound

International arrivals rebounded strongly in 2025 and are forecast to top 813.7 million across Asia-Pacific by 2027[2]Source: Pacific Asia Travel Association, “Asia Pacific Visitor Forecasts 2025-2027,” pata.org . Travelers favor entire-home rentals that minimize shared spaces, a preference that materialized during the pandemic and remains sticky. Domestic exploration also persists, padding occupancy during shoulder seasons when outbound travel historically siphoned demand. These dynamics support ADR resilience even as hotel capacity returns.

Restraints Impact Analysis

| Restraint | (~) % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Tightening zoning and permit rules | -2.3% | North America & Europe urban centers | Short term (≤ 2 years) |

| Community-backlash-driven insurance hikes | -1.8% | Global, concentrated in high-density urban areas | Medium term (2-4 years) |

| Rising professional-cleaning costs | -1.2% | Global, with highest impact in North America & Europe | Medium term (2-4 years) |

| Traveler safety and hygiene concerns | -0.9% | Global, particularly in emerging markets | Short term (≤ 2 years) |

Source: Mordor Intelligence

Tightening Zoning and Permit Rules

Municipalities from New York to Barcelona are capping nightly stays, mandating host presence, or restricting rental days per year. Compliance adds license fees, fire-safety upgrades, and data-reporting obligations that pressure margins for casual hosts. Supply compression in city cores displaces demand to suburban rings and rural counties where permitting is lighter, reshaping the geographic mix of the short term vacation rental market.

Community-backlash-driven Insurance Hikes

Escalating liability claims for party damage and neighbor disputes have led insurers to re-rate short-term rental risk pools. Premiums for comprehensive policies covering guest injury and property loss climbed steeply in 2025, especially in condo associations that now require additional named-insured riders. For small landlords, higher coverage costs narrow profitability and deter new entrants, tilting growth toward professionally managed portfolios with group insurance leverage.

Segment Analysis

By Accommodation Type: Unique Stays Drive Premium Growth

Apartments and condominiums retained 48.38% of bookings in 2024 as they balance privacy, central locations, and predictable amenities. This mainstream segment anchors revenue stability for the short-term vacation rental market, yet ADR uplift is constrained by competitive supply. Unique stays—treehouses, houseboats, and yurts—benefit from social-media virality and are expanding at a 14.95% CAGR, capturing travelers who value novelty over star ratings.

Demand for distinctive design encourages owners to retrofit silos, lighthouses, and heritage cottages, enabling premium nightly rates that exceed local apartment benchmarks. Smart-home devices, from keypad locks to voice-controlled climate systems, now appear across all categories, and listings that advertise remote-work readiness exhibit higher conversion. Consequently, the short term vacation rental market size for unique stays is projected to reach double-digit billion-dollar levels by 2030, reshaping ADR averages across rural destinations.

Note: Segment shares of all individual segments available upon report purchase

By Booking Channel: Property Manager Platforms Gain Traction

Online travel agencies delivered 65.34% of 2024 gross bookings through a wide consumer reach and loyalty programs. Yet hosts increasingly seek analytics dashboards, yield management, and guest-screening tools found on specialized property manager platforms, which are growing at 15.13% CAGR. Integration with channel managers allows inventory to flow seamlessly into both agency portals and direct websites, minimizing vacancy.

Guesty, Hostaway, and similar vendors attracted large venture rounds in 2024, validating investors' belief that professionalized management unlocks incremental revenue within the short-term vacation rental industry. For hosts, the commission delta versus self-management is offset by higher ADRs, fewer double-bookings, and compliance automation. As the ecosystem matures, the short-term vacation rental market size booked through manager platforms is expected to outpace owner-direct reservations, creating a tiered distribution landscape.

Note: Segment shares of all individual segments available upon report purchase

By Guest Type: Digital Nomads Reshape Market Dynamics

Leisure travelers still account for 44.56% of stays, but booking windows compress as consumers plan spontaneous getaways enabled by flexible work calendars. The digital-nomad cohort, expanding at 14.70% CAGR, books multi-week periods that mitigate shoulder-season dips and raise lifetime value per customer. This shift compels hosts to install coworking nooks, surge-protected outlets, and blackout curtains to replicate an office environment.

Corporations exploring hybrid off-sites are also experimenting with full-property takeovers that merge workshops with team-building excursions. Event-based travelers, although smaller in yearly volume, deliver predictable peaks around festivals and sports tournaments, aiding revenue-management algorithms. With diversified use cases, the short-term vacation rental market maintains resilience against single-segment downturns and captures share from legacy serviced apartments.

Geography Analysis

North America dominated with 38.67% revenue in 2024, reflecting platform origin, strong consumer familiarity, and a patchwork regulatory environment that simultaneously constrains and legitimizes growth. United States metros such as Phoenix and Miami post the highest host revenues, yet city-level caps in New York push supply toward upstate counties. Canada and Mexico nurture demand from digital nomads attracted to favorable visa schemes and comparatively lower living costs. Regulatory uniformity is unlikely, so hosts invest in compliance software that aligns listing calendars with local permit quotas.[3]Source: Federal Trade Commission, “FTC Bans Hidden Resort Fees,” ftc.gov

Asia-Pacific leads growth at 14.24% CAGR. China’s domestic tourism surge benefits regional brands like Tujia, while Japan’s inbound rebound drives revenue hotspots in Hakuba and Okinawa, where annual earnings top USD 60,000 per property. India, Thailand, and Indonesia ramp up infrastructure spending on airports and highways, opening secondary towns to international guests. Government marketing campaigns and visa waivers further fuel booking surges, ensuring the short-term vacation rental market can tap rising middle-class spending.

Europe remains a mature but evolving landscape. New EU data-sharing rules require platforms to transmit stay counts and host IDs to municipalities, boosting transparency and tax compliance. France tightened registration in 2025, and Spain’s one-stop portal standardizes host onboarding. Southern beach destinations continue to command premium ADR, while Central and Eastern Europe lure cost-sensitive digital nomads. Though compliance expenses rise, standardized processes may eventually lower administrative burdens and foster cross-border expansion.

Competitive Landscape

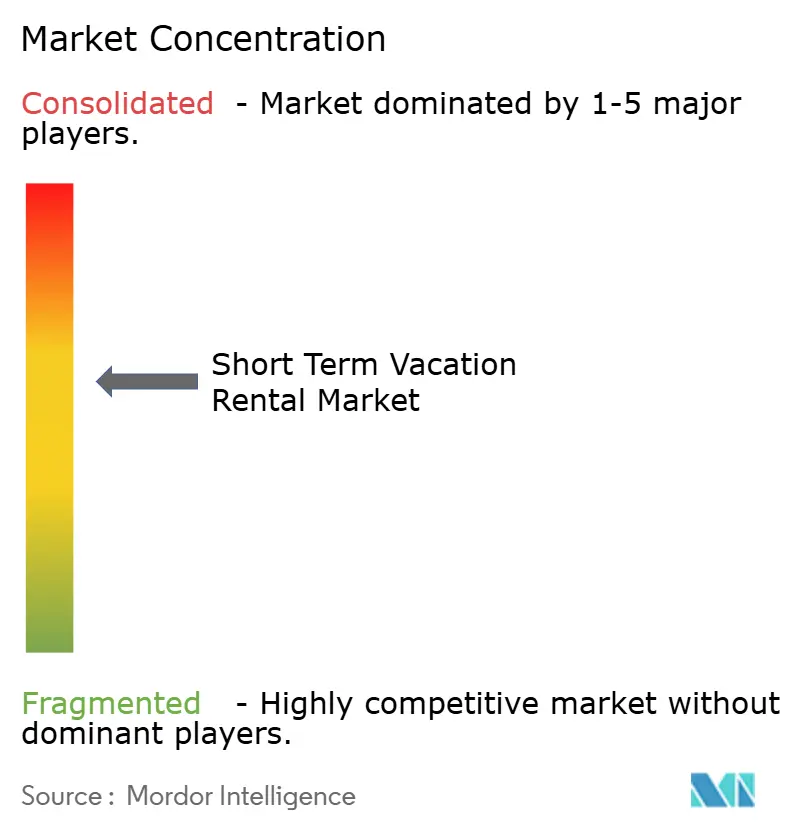

The top five platforms—Airbnb, Booking Holdings, Expedia Group, Trip.com Group, and Vacasa—collectively command a sizable portion of global bookings, yet thousands of regional property managers and specialty channels retain meaningful share. Each major player invests heavily in artificial-intelligence pricing, guest-verification technology, and app-based loyalty perks to lock in both supply and demand. Airbnb’s integration of HotelTonight displays adjacency moves into boutique hotels, blurring lines between accommodation formats.

Consolidation is accelerating. HomeToGo’s agreement to acquire Interhome bolsters European inventory breadth, while Casago’s USD 128.6 million purchase of Vacasa signals that private capital sees upside in integrated property service platforms. AvantStay’s step into full-service hotels showcases hybrid models that combine hotel-grade operations with home-style layouts. Amid these shifts, niche disruptors emphasize carbon-neutral stays, pet-friendly filtering, or blockchain identity verification, squeezing differentiation for larger incumbents.

Operational excellence is paramount. Hosts adopting AI-driven dynamic pricing record occupancy gains and improved rev-par, reinforcing the value proposition of enterprise software partners. Insurance consortiums negotiated by manager brands lower individual policy costs, adding another moat. Given that the five largest companies do not yet surpass 70% combined share, the market retains moderate concentration and ample entry points for innovative challengers.

Short Term Vacation Rental Industry Leaders

-

Airbnb, Inc

-

Booking Holdings Inc

-

Expedia Group, Inc

-

Trip.com Group Ltd.

-

Vacasa, LLC

- *Disclaimer: Major Players sorted in no particular order

Recent Industry Developments

- April 2025: AvantStay acquired VacationHomes365’s Los Angeles assets and unveiled plans to open its first full-service hotel in Nashville, signaling a hybrid lodging strategy.

- February 2025: HomeToGo reached terms to buy Interhome, strengthening one of Europe’s largest vacation rental portfolios.

- January 2025: Casago finalized the acquisition of Vacasa for USD 128.6 million, creating a combined platform with over 40,000 North American properties.

Global Short Term Vacation Rental Market Report Scope

The short-term vacation rental market is defined as a segment of the hospitality industry where private residences, such as homes, apartments, or individual rooms, are rented to travelers for brief periods, typically less than 30 days.

The Short-Term Vacation Rental Market is segmented by accommodation type, price range, booking channel, and region. By accommodation type, the market is segmented into apartments, villas, cottages, houses, cabins, and condos. By price range, the market is segmented into budget, mid-range, and luxury. By booking channel, the market is segmented into online travel agencies, direct bookings (via host websites), and offline channels. By region, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. The report offers market size and forecasts in terms of value (USD) for all the above segments.

| By Accommodation Type | Apartments / Condominiums | ||

| Homes / Villas | |||

| Cabins / Cottages | |||

| Unique Stays (Treehouses, Boats, Yurts) | |||

| By Booking Channel | Online Travel Agencies (OTAs) | ||

| Direct Owner Websites | |||

| Property-Manager Platforms | |||

| By Guest Type | Leisure Travelers | ||

| Business and Bleisure Travelers | |||

| Digital Nomads / Remote Work | |||

| Event-based Travelers | |||

| By Geography | North America | Canada | |

| United States | |||

| Mexico | |||

| South America | Brazil | ||

| Peru | |||

| Chile | |||

| Argentina | |||

| Rest of South America | |||

| Asia-Pacific | India | ||

| China | |||

| Japan | |||

| Australia | |||

| South Korea | |||

| South East Asia (Singapore, Malaysia, Thailand, Indonesia, Vietnam, and Philippines) | |||

| Rest of Asia-Pacific | |||

| Europe | United Kingdom | ||

| Germany | |||

| France | |||

| Spain | |||

| Italy | |||

| BENELUX (Belgium, Netherlands, and Luxembourg) | |||

| NORDICS (Denmark, Finland, Iceland, Norway, and Sweden) | |||

| Rest of Europe | |||

| Middle East and Africa | United Arab Emirates | ||

| Saudi Arabia | |||

| South Africa | |||

| Nigeria | |||

| Rest of Middle East and Africa | |||

| Apartments / Condominiums |

| Homes / Villas |

| Cabins / Cottages |

| Unique Stays (Treehouses, Boats, Yurts) |

| Online Travel Agencies (OTAs) |

| Direct Owner Websites |

| Property-Manager Platforms |

| Leisure Travelers |

| Business and Bleisure Travelers |

| Digital Nomads / Remote Work |

| Event-based Travelers |

| North America | Canada |

| United States | |

| Mexico | |

| South America | Brazil |

| Peru | |

| Chile | |

| Argentina | |

| Rest of South America | |

| Asia-Pacific | India |

| China | |

| Japan | |

| Australia | |

| South Korea | |

| South East Asia (Singapore, Malaysia, Thailand, Indonesia, Vietnam, and Philippines) | |

| Rest of Asia-Pacific | |

| Europe | United Kingdom |

| Germany | |

| France | |

| Spain | |

| Italy | |

| BENELUX (Belgium, Netherlands, and Luxembourg) | |

| NORDICS (Denmark, Finland, Iceland, Norway, and Sweden) | |

| Rest of Europe | |

| Middle East and Africa | United Arab Emirates |

| Saudi Arabia | |

| South Africa | |

| Nigeria | |

| Rest of Middle East and Africa |

Key Questions Answered in the Report

What is the current value of the short term vacation rental market?

The market reached USD 131.45 billion in 2025.

How fast is the short term vacation rental market expected to grow?

It is forecast to expand at an 11.12% CAGR, reaching USD 222.70 billion by 2030.

Which accommodation type is growing the fastest?

Unique stays such as treehouses and houseboats are projected at a 14.95% CAGR through 2030.

Why are property manager platforms gaining traction?

They deliver revenue optimization, compliance automation, and guest-experience tools, outpacing other channels with 15.13% forecast CAGR.

Which region will contribute most to future growth?

Asia-Pacific leads with a projected 14.24% CAGR thanks to rising disposable incomes and tourism infrastructure development.

What years does this Short Term Vacation Rental Market cover, and what was the market size in 2024?

In 2024, the Short Term Vacation Rental Market size was estimated at USD 15.57 billion. The report covers the Short Term Vacation Rental Market historical market size for years: 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Short Term Vacation Rental Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Page last updated on: July 6, 2025