Art Tourism Market Size and Share

Art Tourism Market Analysis by Mordor Intelligence

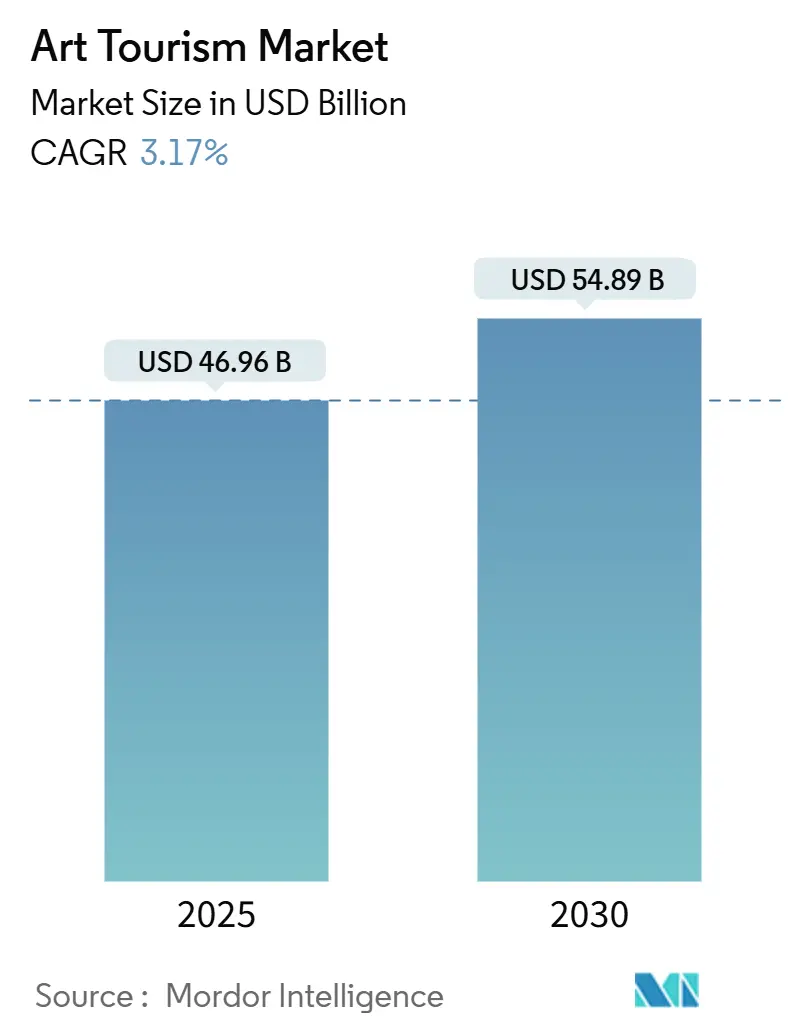

The art tourism market reached USD 46.96 billion in 2025 and is forecast to expand to USD 54.89 billion by 2030, reflecting a 3.17% CAGR. Rising demand for immersive cultural experiences, rapid progress in mixed-reality technologies, and supportive public policies are guiding measured growth as travel recovers and digital consumption habits mature. Generational shifts favor experience-centric spending while government grants, tax incentives, and infrastructure upgrades increase institutional capacity and open fresh revenue streams. Technology enables new formats that complement, rather than replace, traditional venues, allowing operators to diversify earnings and widen participation. However, higher travel costs, geopolitical frictions, and carbon concerns temper the pace and force stakeholders to explore hybrid physical–digital offerings and regional dispersion strategies that lower risk.

Key Report Takeaways

- By art format, museums and galleries led with 42.36% of art tourism market share in 2024, while Virtual/VR Art Tours are projected to accelerate at a 5.79% CAGR to 2030.

- By traveller type, Sightseeing Cultural Tourists held 38.26% of the art tourism market share in 2024; Purposeful Art Tourists recorded the strongest 5.14% CAGR through 2030.

- By booking channel, online OTAs and platforms captured 55.61% share of the art tourism market size in 2024, whereas mobile-app self-guided services are growing at a 4.79% CAGR over 2025-2030.

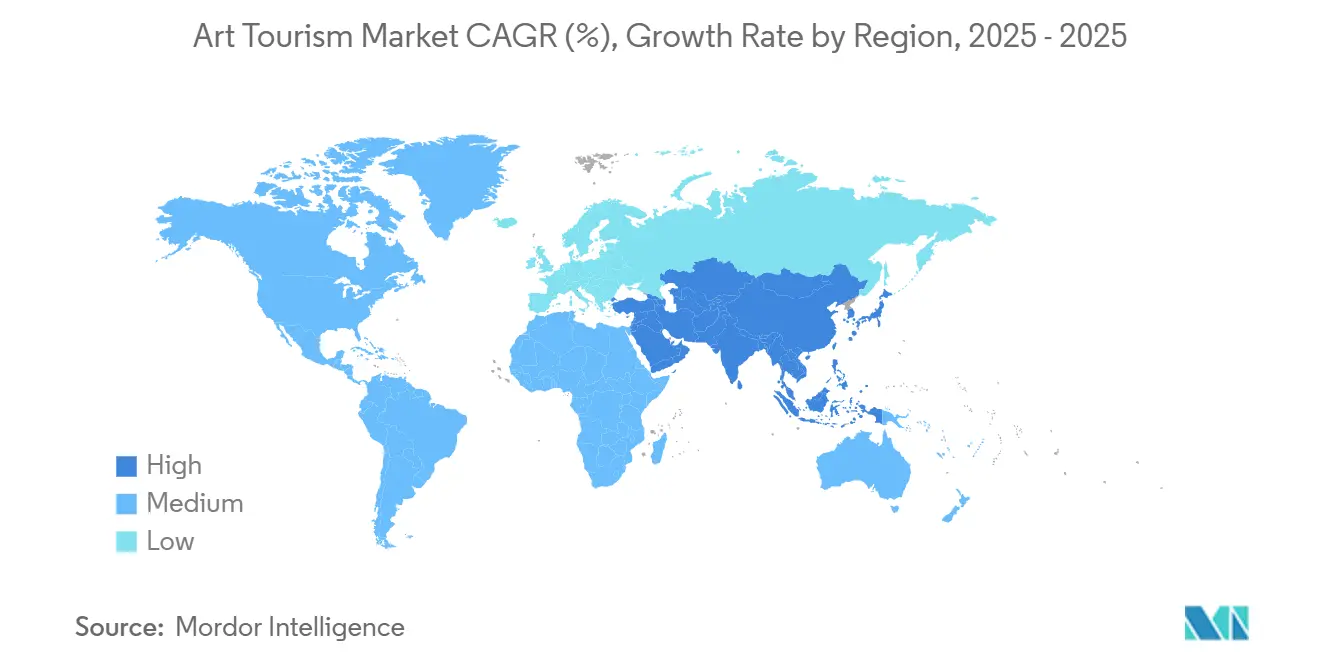

- Europe remained the largest regional node with 38.15% revenue share in 2024; Asia-Pacific delivers the fastest 5.37% CAGR as cultural spending and technological adoption both climb.

- GetYourGuide, Viator, Fever Labs, TeamLab, and Klook collectively hold a moderate leadership block within the art tourism market.

Global Art Tourism Market Trends and Insights

Drivers Impact Analysis

| Driver | (~) % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Millennials and Gen-Z quest for experiential travel | +0.8% | Global, with concentration in North America & Europe | Medium term (2-4 years) |

| Surge in global art festivals and biennales | +0.6% | Global, particularly Europe & Asia-Pacific | Long term (≥ 4 years) |

| Government investments in culture-led regeneration | +0.5% | Asia-Pacific core, spill-over to Europe & MEA | Long term (≥ 4 years) |

| Monetisation of VR/AR-enabled virtual art tours | +0.4% | Global, early adoption in North America & Asia-Pacific | Medium term (2-4 years) |

| Pivot to pop-up immersive art venues | +0.3% | North America & Europe, expanding to Asia-Pacific | Short term (≤ 2 years) |

Source: Mordor Intelligence

Millennials and Gen-Z Quest for Experiential Travel

Younger travellers allocate a growing share of holiday budgets to immersive culture, and experiential purchases reached 12% of overall tourism spending in 2024 Mastercard. Social media amplification makes shareable moments central to trip planning, and Visa transactional data links spikes in destination bookings to viral cultural content, Visa Business and Economic Insights. A Skyscanner survey found 54% of respondents aged 18-35 selected their 2024 trips primarily for culture, Hotel Executive. Institutions respond with storytelling installations, limited-capacity workshops, and flexible ticketing that converts aspirations into revenue. The result is a virtuous loop where digitally literate audiences co-create narratives, boosting dwell time and secondary spend.

Surge in Global Art Festivals and Biennales

Large-scale events such as the Venice Biennale 2025 and Expo 2025 Osaka catalyze region-wide visitor inflows, EASTWEST. Emerging economies mobilize festivals to burnish cultural brands; Uzbekistan hosted its inaugural Bukhara Biennial, and Benin earmarked EUR 250 million for four museums by 2026, The Art Newspaper. Spain’s Mondi cult 2025 will gather 194 UNESCO members to frame global cultural policy, Ministerio de Asuntos Exteriores, Unión Europea y Cooperación[1]Source: Ministerio de Asuntos Exteriores, Unión Europea y Cooperación, “Mondiacult 2025,” exteriores.gob.es . These gatherings elongate travel seasons, revive shoulder months, and stimulate permanent infrastructure upgrades that outlast closing ceremonies. Year-round employment rises, and destinations reposition themselves as knowledge and creative hubs.

Government Investments in Culture-Led Regeneration

China’s Action Plan for Smart Tourism integrates VR and AR into heritage sites, with 80% of domestic travelers willing to pay premiums for tech-enhanced visits, Government of China[2]Source: U.S. Department of Commerce, “Greece Recovery and Resilience Facility,” trade.gov . The European Union recovery facility allocated USD 420 million to Greek tourism, directing USD 349 million to mountain heritage accessibility, U.S. Department of Commerce[3]Source: U.S. Department of Commerce, “EU Recovery Funds: Greece,” trade.gov. Canada’s CAD 23 billion Federal Tourism Growth Strategy embeds cultural tourism within post-pandemic revitalization,n Innovation, Science and Economic Development Canada. Such programs lower private financing hurdles, speed digital adoption, and anchor heritage preservation in wider economic strategies. The art tourism market, therefore, enjoys policy tailwinds that reduce capital costs and encourage innovation.

Monetisation of VR/AR-Enabled Virtual Art Tours

Over 350 immersive venues operated worldwide by end-2024 The Art Newspaper. TeamLab’s new Tokyo flagship charges JPY 1,500–3,800 (USD 10-25) per ticket Tokyo Convention & Visitors Bureau, while optional digital collectibles extend engagement beyond the visit. Revenue stacks now include admission, licensing, virtual merchandise, and hybrid on-site events, diversifying income. European museums use VR to meet accessibility mandates and sustainability goals Sustainability. Quality remains essential as audiences become more discerning; criticism of superficial installations in the United Kingdom underscores reputational risk The Guardian. Authentic content and reliable storytelling differentiate winning propositions.

Restraints Impact Analysis

| Restraint | (~) % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Rising travel and ticketing costs | -0.7% | Global, particularly affecting long-haul destinations | Short term (≤ 2 years) |

| Geopolitical/visa frictions | -0.5% | Global, concentrated in Asia-Pacific & Europe corridors | Medium term (2-4 years) |

| Carbon-footprint scrutiny of long-haul trips | -0.3% | Global, strongest in Europe & North America | Long term (≥ 4 years) |

| "Immersion fatigue" among repeat visitors | -0.2% | Mature markets in North America & Europe | Medium term (2-4 years) |

Source: Mordor Intelligence

Rising Travel and Ticketing Costs

French museums adopted tiered pricing in 2024 that charges non-EU visitors more, raising equity concerns, Observer ArtNews. Airlines face fuel price volatility and capacity limits that especially squeeze intercontinental routes. Younger cohorts with limited savings feel the pinch first, potentially slowing spontaneous cultural trips. Voucher schemes and dynamic pricing offer partial relief but rely on sustained public financing. Operators are responding with shorter regional itineraries, bundle discounts, and virtual add-ons that preserve access while containing costs.

Geopolitical/Visa Frictions

Art Basel Hong Kong attendance dropped to 75,000 in 2024 from 86,000 in 2023, Artnet News. Visa delays complicate planning, and shifting diplomatic climates can impose sudden travel restrictions that disrupt marketing calendars and loan agreements. Emerging destinations depend on international validation, so disruptions undermine revenue and soft-power goals simultaneously. Partnerships such as the Hong Kong Tourism Board’s three-year agreement with Art Basel try to offset uncertainty, yet resilience planning remains essential for organisers.

Segment Analysis

By Art Format: Digital Immersion Challenges Traditional Venues

Museums and Galleries controlled 42.36% of art tourism market share in 2024, underscoring enduring trust in curated collections. The segment remains the primary entry point for mainstream travelers, and many institutions now embed projection mapping and interactive labels to meet rising expectations. Virtual/VR Art Tours are forecast to grow at a 5.79% CAGR to 2030, reflecting confident consumer adoption and broader headset availability. The art tourism market size attributed to VR tours is projected to grow alongside platform distribution deals that bundle tickets with remote learning modules. Immersive Digital Art Experiences such as Outernet London welcomed 6.25 million visitors in their first year The Art Newspaper, proving that high-resolution media installations can match or exceed flagship museum footfall. Festivals and Events maintain temporal exclusivity that drives urgency and social sharing. Public/Street-Art Tours thrive on urban regeneration momentum, whereas Workshops and Residencies attract hobbyists who seek hands-on creativity.

Adapting to these shifts, leading museums partner with technology firms to deploy multi-language AR guides while preserving curatorial integrity. Hybrid ticket models now combine timed entry with on-demand digital viewing, allowing institutions to smooth capacity peaks and advance monetisation. Start-ups offering turnkey projection domes and AI-generated art displays find receptive city councils looking to animate dormant retail space. A clear pattern emerges where physical authenticity and digital immersion operate in tandem, converting one-time viewers into engaged communities. Success hinges on storytelling quality, ease of booking, and responsive interpretation rather than format alone.

Note: Segment shares of all individual segments available upon report purchase

By Traveller Type: Purpose-Driven Engagement Accelerates

Sightseeing Cultural Tourists formed the largest cohort at 38.26% of the art tourism market in 2024. They often combine landmark visits with broader holiday itineraries, making them sensitive to bundle prices and transport connectivity. Yet, Purposeful Art Tourists, who travel primarily to engage with art, will outpace others with a 5.14% CAGR in the forecast window. The art tourism market size attached to purposeful travellers is expected to expand as curators launch behind-the-scenes tours, artist meet-ups, and night-time openings aimed at this high-engagement group. Serendipitous Tourists benefit from improved discovery tools that surface nearby events, while Casual and Incidental segments supply steady volumes that support entry-level products.

Destination marketers increasingly design tiered experiences that encourage gradual deepening of engagement. For example, a city pass may combine basic gallery entry with optional upgrades to artist talks. Data captured via mobile apps helps personalise recommendations, nudging repeat visits and cross-selling ancillary services such as culinary classes or craft workshops. As loyalty builds, travellers transition from casual to purposeful segments, raising average spend and stabilising off-peak demand.

Note: Segment shares of all individual segments available upon report purchase

By Booking Channel: Mobile Technology Drives Self-Guided Growth

Online OTAs and Platforms held a 55.61% share in 2024, benefiting from global inventory reach, instant confirmation, and trusted payment gateways. The art tourism market continues to rely on these aggregators for breadth, yet Mobile-app Self-guided solutions post a 4.79% CAGR through 2030 as algorithms refine personalised routing. For institutions, white-label apps offer data ownership and targeted upselling. The art tourism market size attached to direct mobile bookings is rising fastest in urban destinations where dense clusters of venues allow flexible hop-on experiences. Traditional Tour Operators retain relevance for complex, multi-country trips, while Direct-to-Attraction portals capitalise on loyal members and advance-reservation perks.

Frictionless ticket delivery, QR-based fast lanes, and embedded translation services enhance perceived value. Augmented reality overlays convert city streets into interactive canvases, further encouraging independent exploration. As roaming fees fall and 5G coverage broadens, self-guided usage is likely to convert even cautious demographics. Operators that integrate loyalty wallets and carbon-tracking dashboards can differentiate further by aligning with sustainability priorities.

Geography Analysis

Europe retained 38.15% of global revenue in 2024 and remains the benchmark for institutional depth, transport connectivity, and cross-border cultural itineraries. Differential pricing for non-EU visitors at French landmarks signals short-term fiscal pressure but might erode competitiveness long term Artforum. Venice’s contemporary repositioning efforts illustrate the challenge of balancing overtourism control with innovation The New York Times. Programmes like the Getty-funded PST Art emphasise sustainability, echoing rising visitor expectations for low-impact experiences The Art Newspaper. Regional collaborative marketing, such as European Capitals of Culture, lengthens stay duration and spreads traffic beyond primary gateways.

Asia-Pacific delivers the fastest 5.37% CAGR, driven by expanding middle-class demand and pro-innovation regulations. China recorded USD 12.2 billion in art sales in 2023 Nikkei Asia. The national policy package for digital culture positions the country as an incubator for smart tourism Government of China. PATA projects regional arrivals to reach 813.7 million by 2027, and a significant share will target creative districts and immersive pop-ups Hospitality Net. Japan leverages TeamLab’s global cachet, drawing international travellers to Tokyo’s Azabudai Hills venue The Art Newspaper. Adaptive reuse of industrial sites into cultural parks accelerates supply.

North America shows steady rebound as entrepreneurial museums re-position themselves as community anchors. Pittsburgh’s Andy Warhol Museum leads with an USD 80 million Pop District plan The Art Newspaper. Cities invest in public-private partnerships that integrate arts, dining, and innovation hubs to diversify downtown economies. South America leverages heritage corridors and local artisan networks to foster inclusive tourism that benefits regional communities. Middle East & Africa finance cultural mega-projects to support diversification from resource revenues, with Gulf states rolling out digital heritage preservation platforms that scale access. While share remains lower than Europe or Asia-Pacific, improved air links and cooperation visas set a foundation for accelerated growth from 2026 onward.

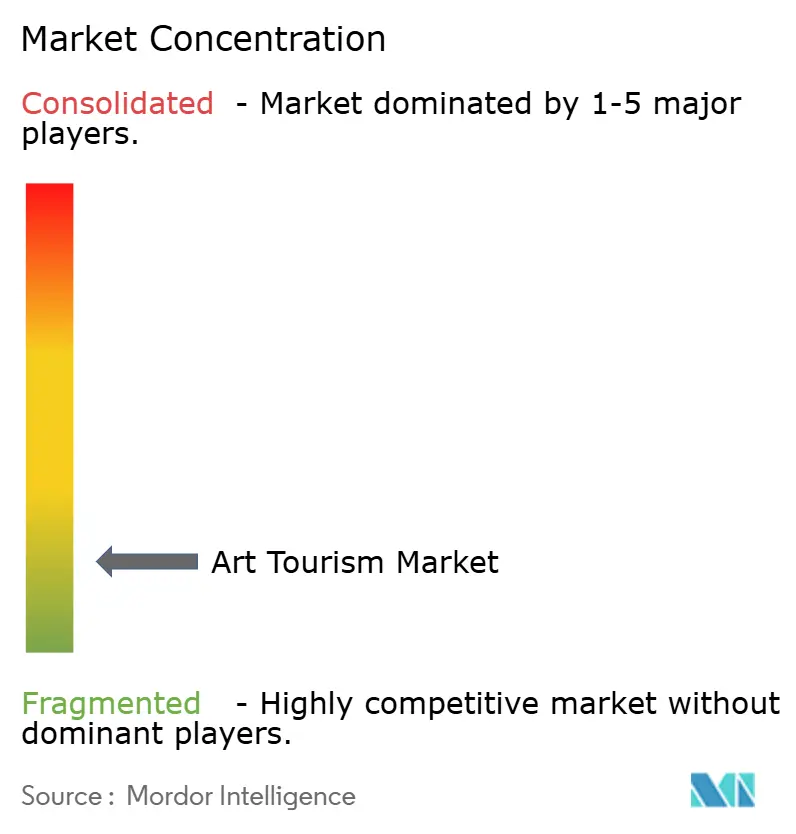

Competitive Landscape

The art tourism market is moderately concentrated. GetYourGuide, Viator, Fever Labs, TeamLab, and Klook form the top tier and leverage distinctive capabilities. Platform aggregators capture bookings at scale through search-engine visibility and enterprise API integrations that feed airline and hotel bundles. Content creators such as TeamLab and Fever Labs own proprietary intellectual property, allowing premium pricing and franchise expansion into shopping malls and waterfront redevelopments. Technology integrators supply turnkey AR platforms that museums license to modernise interpretation without extensive in-house R&D.

Strategic partnerships are common. In 2024, Rezdy, Checkfront, and Regiondo merged under a USD 150 million investment to form a 17,000-client booking-tech player, PhocusWire, challenging incumbents on back-end efficiency. Meow Wolf’s planned New York City outpost illustrates geographic broadening that targets high-density inbound flows, Fast Company. Acquisitions such as the July 2024 purchase of Claudine Colin Communication by Finn Partners expand international PR capability, The Art Newspaper. Competitive advantage increasingly stems from ecosystem orchestration, where player success depends on linking discovery, payment, experience, and post-visit engagement within a single trusted environment. Barriers to entry remain moderate because software builds are capital light, yet content authenticity and global licensing networks are harder to replicate.

Effective differentiation now blends data analytics, sustainability commitments, and local artist inclusion. Market leaders integrate carbon calculators and donation opt-ins that let visitors offset emissions, responding to rising environmental scrutiny. Digital badges that verify fair-pay artist contracts build social trust. Smaller entrants carve niches in heritage-rich secondary cities, often backed by municipal grants that promote regeneration. Continuous format innovation, combined with deliberate localisation, is expected to maintain competitive dynamism through the decade.

Art Tourism Industry Leaders

-

GetYourGuide GmbH

-

Viator (Tripadvisor)

-

Fever Labs

-

TeamLab

-

Klook

- *Disclaimer: Major Players sorted in no particular order

Recent Industry Developments

- March 2025: Meow Wolf announced its seventh museum at Manhattan’s Pier 17, expanding into New York City with collaboration from local artists Fast Company.

- July 2024: Finn Partners acquired Claudine Colin Communication to increase global arts sector reach The Art Newspaper.

- May 2024: TeamLab opened its immersive venue at Azabudai Hills in Tokyo with 75 interactive artworks, The Art Newspaper.

Global Art Tourism Market Report Scope

The art tourism market is defined as the travel sector focused on individuals seeking art and cultural experiences through visits to museums, galleries, exhibitions, and landmarks. It includes guided tours, events, and virtual art experiences, appealing to collectors, enthusiasts, and tourists looking for cultural enrichment and immersive experiences.

The art tourism market is segmented into type of art, tourism type, and region. By type of art, the market is segmented into fine arts tourism, cultural heritage and folk art tourism, performing arts tourism, and art fairs and festivals. By tourism type, the market is segmented into domestic art tourism and international art tourism. By booking channel, the market is segmented into, Online and Offline. By region, the market is segmented into North America, Europe, Asia-Pacific, Middle East and Africa, and Latin America. The report offers market size and forecasts in terms of value in (USD) for all the above segments.

| By Art Format | Museums and Galleries | ||

| Immersive Digital Art Experiences | |||

| Art Festivals and Events | |||

| Public/Street-Art Tours | |||

| Art Workshops and Residencies | |||

| Virtual/VR Art Tours | |||

| By Traveller Type | Purposeful Art Tourists | ||

| Sightseeing Cultural Tourists | |||

| Serendipitous Tourists | |||

| Casual Tourists | |||

| Incidental Tourists | |||

| By Booking Channel | Online OTAs and Experience Platforms | ||

| Direct-to-Attraction | |||

| Tour Operators and Guides | |||

| Mobile-App Self-guided Tours | |||

| By Geography | North America | Canada | |

| United States | |||

| Mexico | |||

| South America | Brazil | ||

| Peru | |||

| Chile | |||

| Argentina | |||

| Rest of South America | |||

| Asia-Pacific | India | ||

| China | |||

| Japan | |||

| Australia | |||

| South Korea | |||

| South East Asia (Singapore, Malaysia, Thailand, Indonesia, Vietnam, and Philippines) | |||

| Rest of Asia Pacific | |||

| Europe | United Kingdom | ||

| Germany | |||

| France | |||

| Spain | |||

| Italy | |||

| BENELUX (Belgium, Netherlands, and Luxembourg) | |||

| NORDICS (Denmark, Finland, Iceland, Norway, and Sweden) | |||

| Rest of Europe | |||

| Middle East and Africa | United Arab Emirates | ||

| Saudi Arabia | |||

| South Africa | |||

| Nigeria | |||

| Rest of Middle East and Africa | |||

| Museums and Galleries |

| Immersive Digital Art Experiences |

| Art Festivals and Events |

| Public/Street-Art Tours |

| Art Workshops and Residencies |

| Virtual/VR Art Tours |

| Purposeful Art Tourists |

| Sightseeing Cultural Tourists |

| Serendipitous Tourists |

| Casual Tourists |

| Incidental Tourists |

| Online OTAs and Experience Platforms |

| Direct-to-Attraction |

| Tour Operators and Guides |

| Mobile-App Self-guided Tours |

| North America | Canada |

| United States | |

| Mexico | |

| South America | Brazil |

| Peru | |

| Chile | |

| Argentina | |

| Rest of South America | |

| Asia-Pacific | India |

| China | |

| Japan | |

| Australia | |

| South Korea | |

| South East Asia (Singapore, Malaysia, Thailand, Indonesia, Vietnam, and Philippines) | |

| Rest of Asia Pacific | |

| Europe | United Kingdom |

| Germany | |

| France | |

| Spain | |

| Italy | |

| BENELUX (Belgium, Netherlands, and Luxembourg) | |

| NORDICS (Denmark, Finland, Iceland, Norway, and Sweden) | |

| Rest of Europe | |

| Middle East and Africa | United Arab Emirates |

| Saudi Arabia | |

| South Africa | |

| Nigeria | |

| Rest of Middle East and Africa |

Key Questions Answered in the Report

What is the current value of the art tourism market?

The art tourism market stands at USD 46.96 billion in 2025.

How fast will the art tourism market grow by 2030?

The market is projected to reach USD 54.89 billion by 2030, registering a 3.17% CAGR.

Which region leads the art tourism market?

Europe is the largest regional contributor with 38.15% share in 2024.

Which is the fastest growing region in Art Tourism Market?

Asia-Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

What format is growing fastest in art tourism?

Virtual or VR art tours are expanding at a 5.79% CAGR through 2030 as headsets and content become mainstream.

Who are the major companies in the art tourism market?

GetYourGuide, Viator, Fever Labs, TeamLab, and Klook occupy leading positions with scale or proprietary content advantages.

Page last updated on: July 6, 2025