Pet Hotels Market Size and Share

Pet Hotels Market Analysis by Mordor Intelligence

The pet hotels market currently generates USD 6.00 billion in 2025 revenue and is forecast to reach USD 8.93 billion by 2030, advancing at an 8.29% CAGR. Robust growth stems from a steady rise in global pet ownership, higher discretionary income, and the willingness of owners to purchase hotel-grade services such as webcam monitoring and climate-controlled suites. North America retains spending leadership, yet Asia-Pacific has become the most dynamic region owing to rising urban affluence and smaller household sizes. Digital booking is shifting share toward mobile platforms, while franchise roll-outs supply rapid capacity and recognizable brand standards. At the same time, tightening welfare regulations, escalating urban rents, and labour-intensive care models encourage consolidation among operators that can fund modern facilities and meet compliance requirements.

Key Report Takeaways

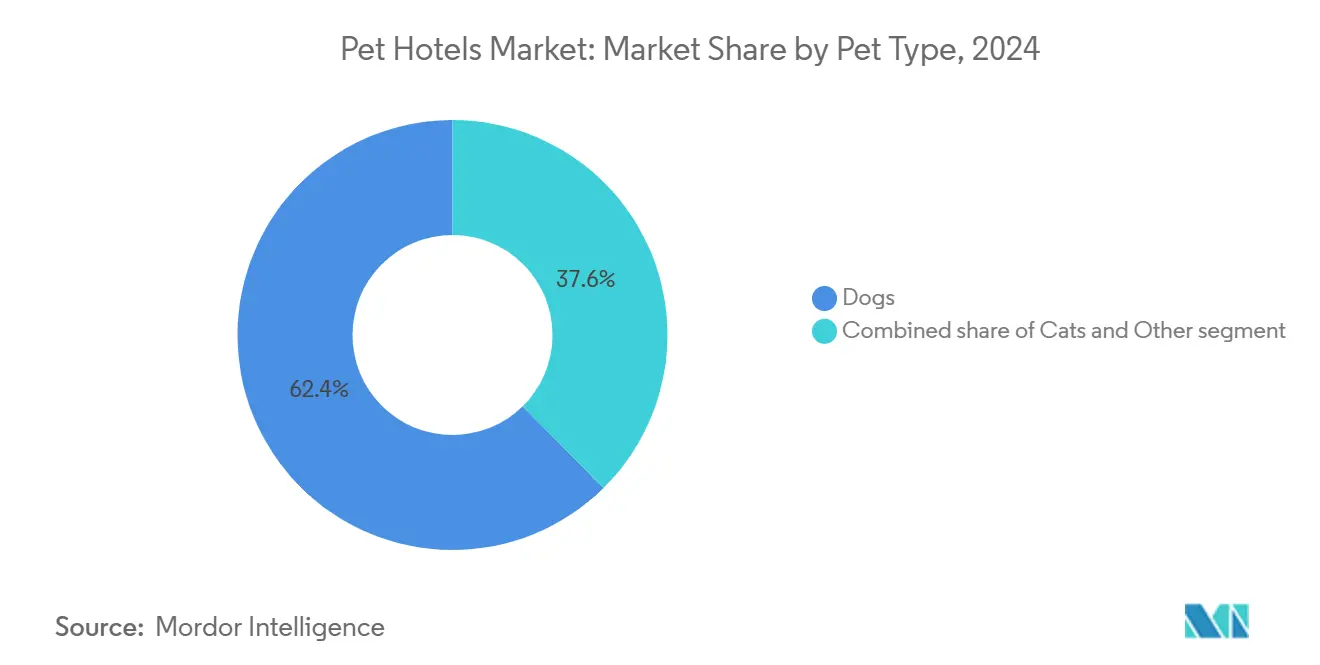

- By pet type, dogs led with 62.45% of the pet hotels market share in 2024, whereas cats are projected to expand at a 9.65% CAGR through 2030.

- By service type, overnight boarding accounted for 53.76% share of the pet hotels market size in 2024, while daycare services posted the fastest 11.45% CAGR to 2030.

- By hotel category, standard facilities commanded 58.69% revenue share of the pet hotels market in 2024; the luxury segment is forecast to grow at 12.67% CAGR.

- By distribution channel, offline and walk-in bookings held a 66.78% share of the pet hotels in 2024, yet online reservations are set to rise at 13.12% CAGR.

- By region, North America captured 42.56% of the pet hotels market in 2024, whereas Asia-Pacific is on track for a 10.68% CAGR through 2030.

Global Pet Hotels Market Trends and Insights

Drivers Impact Analysis

| Driver | (~) % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Rising pet-humanization and premium care | +2.1% | Global, strongest in North America and Europe | Long term (≥ 4 years) |

| Aggressive franchise rollouts | +1.8% | North America is primary, expanding to Asia-Pacific | Medium term (2-4 years) |

| Digital, mobile-first booking platforms | +1.4% | Global, urban centers leading | Short term (≤ 2 years) |

| Airport-adjacent “pre-flight” pet hotels | +0.9% | North America and Europe, major airport hubs | Medium term (2-4 years) |

| Subscription wellness bundles | +0.7% | North America, spreading to other developed markets | Medium term (2-4 years) |

| Climate-controlled, HEPA-filtered suites | +0.6% | Global, climate-sensitive regions | Long term (≥ 4 years) |

Source: Mordor Intelligence

Rising Pet-Humanization and Premium Care

The growing trend of pet owners treating their animals as integral family members has led to increased spending on premium services, including hotel-level accommodations that ensure safety and enrichment. Young adults, particularly those aged 18-34 in the United States, are at the forefront of this shift, driving consistent demand for value-added offerings such as webcam access, tailored activity schedules, and on-site wellness packages. The pet care market has demonstrated resilience to economic fluctuations, with the American Pet Products Association emphasizing the robust global expenditure on pets in 2024. This humanization of pets has also bolstered ancillary revenue streams, including spa treatments and behavioural coaching, thereby increasing average stay values and encouraging service providers to adopt premium market positioning.

Aggressive Franchise Roll-Outs by Pet-Specialty Chains

Franchising provides established branding, streamlined operational frameworks, and access to investment capital, addressing key challenges faced by small independent operators. Camp Bow Wow, with a network exceeding 200 locations, demonstrates strong financial performance and operational stability with minimal unit closures. Similarly, Dogtopia, managing over 250 centers, adopts a daycare-focused model that ensures consistent weekday revenue streams. The scalability of these franchises enables cost efficiencies through bulk procurement, strengthens brand visibility via national marketing initiatives, and drives uniform service quality, fostering customer confidence across extensive geographic markets.

Digital, Mobile-First Booking Platforms

More than 35% of 2025 reservations flow through online channels, rising at a 13.12% CAGR as mobile apps unlock 24/7 self-service, instant vaccination verification, and subscription renewals. Millennial and Gen Z owners regard digital convenience as table stakes, a view echoed in the American Hotel & Lodging Association’s hospitality outlook [3]American Hotel & Lodging Association, “Hospitality Technology Outlook 2025,” ahla.com . Facilities use AI-driven recommendations to upsell grooming or extended playtime; automated reminders cut no-show risk, supporting better capacity utilisation.

Airport-Adjacent “Pre-Flight” Pet Hotels

Roughly 22% of pet owners now take animals on flights. Purpose-built sites near major hubs integrate check-in data, pre-flight health certificates, and cargo transfer services, commanding premium pricing for seamless travel logistics. Extended layovers and weather delays create incremental overnight demand, while stringent aviation rules present barriers that limit entrant numbers.

Restraints Impact Analysis

| Restraint | (~) % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| High fixed costs and a labour-intensive model | −1.9% | Global, acute in high-wage markets | Long term (≥ 4 years) |

| Regulatory patchwork | −1.2% | North America and Europe | Medium term (2-4 years) |

| Rising urban real-estate rents | −0.8% | Urban centers worldwide | Short term (≤ 2 years) |

| Short-notice cancellations | −0.6% | Global, seasonal variations | Short term (≤ 2 years) |

Source: Mordor Intelligence

High Fixed Costs and Labor-Intensive Model

Pet hotels are encountering escalating operational expenses due to the enforcement of strict staff-to-animal ratios, emergency preparedness measures, and the installation of specialized ventilation systems. These requirements significantly increase labor and depreciation costs. Although median franchise revenues may appear robust, they often obscure narrow operating margins after factoring in payroll, insurance, and compliance with regulatory standards, as reported by Vetted Biz. Additionally, the industry faces intensified competition for skilled handlers due to labor shortages. Location-specific assets further expose businesses to risks from natural disasters, which can disrupt operations and occupancy for extended periods.

Regulatory Patchwork

Operators navigate a maze of federal, state, and municipal rules. In 2025, the European Commission mandated microchipping and veterinary oversight for dogs and cats, raising compliance costs and reporting complexity [1]European Commission, “EU Rules on Pet Welfare 2025,” ec.europa.eu . In the United States, the USDA’s Animal Welfare Act sets baseline conditions, yet local zoning laws add distinct noise, traffic, and environmental stipulations [2]U.S. Department of Agriculture – APHIS, “Animal Welfare Act and Regulations,” aphis.usda.gov. Smaller sites often lack the legal bandwidth to keep pace, nudging them toward partnership or sale to larger groups.

Segment Analysis

By Pet Type: Dogs Hold Majority, Cats Accelerate

Dogs contribued 62.45% of 2024 revenue, reflecting their social nature and owners’ preference for communal play yards and tailored activity plans. The pet hotels market size for dogs is expected to grow steadily, but at a pace below the overall average, as penetration is already high. Cats, however, will deliver the fastest 9.65% CAGR, aided by urban apartment living and specialized stress-reduction suites that appeal to feline behaviour. Operators have started dedicating separate wings or ventilation zones to minimise canine scent, thereby lifting occupancy and yield for cat units. Other pet categories—birds, reptiles, and small mammals—though niche, command premium nightly rates because few facilities invest in species-specific enclosures and veterinary protocols. Wealthy owners of exotic animals are willing to pre-pay multi-week blocks, adding predictable revenue during off-peak seasons.

The growth of cat boarding signals a shift away from traditional neighbour check-ins toward professional care with webcam access and vertical playgrounds. Younger owners cite peace of mind and emergency readiness as reasons to book formal accommodation. In the dog segment, luxury suites with private patios and splash pools differentiate brands, while behavioural training add-ons strengthen loyalty. Small-animal offerings often partner with exotic-vet practices, allowing referral traffic and cross-selling of medical services at premium margins.

Note: Segment shares of all individual segments are available upon report purchase

By Service Type: Daycare Gains Momentum

Overnight boarding retained a 53.76% share of the pet hotels market size in 2024 because vacation and business travel remain core demand drivers. Yet daycare services are expanding at 11.45% CAGR as hybrid work schedules and resumed office commutes spur weekday visitation. High-frequency daycare patrons offer operators steady cash flows comparable to gym memberships. Multi-visit packages reduce effective customer-acquisition costs and feed ancillary grooming or retail sales. Grooming itself provides vital smoothing of seasonal occupancy dips, while training classes differentiate premium sites and deepen owner engagement.

Facilities positioned around dense employment hubs now dedicate equal floor space to daytime playrooms outfitted with reinforced flooring and odour control. Some chains extend evening pick-up hours to match commuter patterns, boosting convenience and pricing power. The daycare surge also elevates labour demand for canine coaches who organise enrichment programmes, yet improved utilisation offsets staffing costs. Combined boarding-plus-daycare bundles further enhance average spend and extend stay durations.

By Hotel Category: Luxury Outpaces Standard Offerings

Standard suites generated 58.69% of 2024 revenue by providing dependable care at mid-market prices. Nevertheless, luxury units will clock the highest 12.67% CAGR, mirroring experiential spending trends in human hospitality. Operators invest in memory-foam bedding, in-room smart TVs, and bespoke dietary menus to capture affluent owners. The pet hotels market share captured by luxury is set to rise as urban professionals, many delaying parenthood, redirect discretionary budgets toward premium pet experiences. Boutique concepts emphasise themed décor or breed-specific programmes, appealing to owners seeking Instagram-ready environments. Economy venues face squeeze from rising utility and wage bills, leading some to convert dormitory-style kennels into higher-yield suites or exit the segment altogether.

Luxury expansion is further fuelled by airline-adjacent sites that integrate spa treatments and pre-flight stress alleviation protocols. Chains are also piloting tiered membership clubs offering priority booking and exclusive events such as dog-yoga sessions. Standard hotels counter by upgrading air filtration and adding webcams at lower price increments, preserving occupancy while nudging ADR upward.

By Distribution Channel: Online Adoption Rises

Walk-in and phone reservations still accounted for 66.78% of 2024 bookings, underscoring the trust-based nature of pet care. Yet tech-savvy owners are migrating to mobile apps that show real-time suite availability, vaccination reminders, and loyalty points. Online volumes have been rising 13.12% annually, and many operators now guarantee the lowest pricing through direct digital channels to reduce third-party commission expense. The shift reduces front-desk workload and generates data that informs yield management algorithms. Sites employing omnichannel strategies—combining in-person facility tours with convenient app check-out—report the highest customer-satisfaction scores.

Enhanced payment options, such as split pay and auto-renewing daycare passes, increase booking duration and frequency. Push notifications encourage off-peak grooming add-ons, raising total spend per customer. Moreover, cloud-based CRM systems integrate veterinary records, simplifying compliance checks and expediting holiday-season intake.

Geography Analysis

In 2024, North America generated nearly half of the global revenues. In Canada, urban centers such as Toronto and Vancouver have adopted a premium market positioning, driving increased demand for daycare services due to the prevalence of high-rise living. Conversely, Mexico's growing middle class represents significant growth potential. However, the absence of purpose-built facilities in many municipalities creates opportunities for early entrants with franchise support to establish a foothold. While the USDA Animal Welfare Act provides a standardized regulatory framework at the federal level, varying state-level requirements necessitate adaptable compliance strategies.

Asia-Pacific is the fastest-growing territory, expected to log a 10.68% CAGR through 2030. Urbanisation, single-occupancy housing, and rising disposable income underpin growth in China, Japan, and Australia. Chinese tier-1 cities exhibit luxury bias, with boutique hotels featuring in-room smart devices and bilingual caretaker staff. Japan’s ageing population lavishes attention on companion animals, fuelling demand for wellness-oriented hotels offering physiotherapy and hydrotherapy. Australian operators innovate with large outdoor play zones reflecting domestic pet culture. South Korean and Southeast Asian markets remain nascent but show swift pet adoption, prompting international franchise entrants to adapt menus to local dietary preferences.

Europe maintains solid momentum as welfare regulation standardises quality expectations. The European Commission’s 2025 dog and cat rules—mandating microchipping and veterinary oversight—raise operational thresholds that favour professional chains able to document compliance. The United Kingdom, Germany, and France anchor regional spend, while BENELUX and Nordic countries represent lucrative luxury niches due to high per-capita income. Belgium-based Pet Service Holding NV, through a series of acquisitions, has significantly boosted its revenue and is now setting its sights on expansion in Germany and Eastern Europe.

Competitive Landscape

The pet hotels market remains highly fragmented; the five largest operators—PetSmart, Camp Bow Wow, Dogtopia, Best Friends Pet Care, and K9 Resorts—command less than 20% of global revenue. Such dispersion arises because trust and locality drive booking decisions, and high capital costs slow rapid national rollout. Nevertheless, consolidation is accelerating Pet Resort Hospitality Group acquired five regional brands in March 2024, signalling growing private-equity interest. Franchise systems dominate growth strategies; uniform operating protocols and central marketing lower customer-acquisition costs and speed expansion into secondary cities. Technology investments now separate leaders from laggards, with top chains deploying AI chatbots that cut labour hours by 12% and in-suite cameras that elevate customer satisfaction scores.

Subscription wellness bundles are transforming the competitive dynamics by shifting the emphasis from short-term pricing strategies to maximizing customer lifetime value. Companies integrating services such as daycare, grooming, and veterinary care into bundled offerings are achieving significant reductions in customer attrition rates. Airport-adjacent providers occupy a premium niche insulated by logistics complexity and airline partnerships. Independents respond through region-specific services—for example, desert-climate hotels in Arizona featuring shaded splash pads and monsoon-proof ventilation. Regulatory compliance also shapes rivalry; operators able to exceed USDA or EU welfare standards gain marketing leverage and pre-empt potential legal challenges. Strategic white-spaces persist in emerging middle-income markets and in exotic-pet boarding, where specialist husbandry know-how is scarce.

Private-equity funds view the pet hotels market as a roll-up opportunity comparable to early-stage human health clubs. Competition may intensify around digital discovery platforms, yet facility ownership confers defensible moats through location, zoning permits, and sunk fit-out costs. Success will hinge on blending high-touch care with high-tech efficiencies while navigating evolving welfare statutes.

Pet Hotels Industry Leaders

-

PetSmart (PetsHotel)

-

Camp Bow Wow

-

Dogtopia

-

Best Friends Pet Care

-

K9 Resorts Luxury Pet Hotel

- *Disclaimer: Major Players sorted in no particular order

Recent Industry Developments

- April 2025: Pet Service Holding NV reported a tenfold revenue jump to EUR 12.5 million (USD 13.4 million) for 2024, following several strategic acquisitions.

- January 2025: K9 Resorts celebrated its 20th anniversary, highlighting two decades of luxury pet hospitality leadership.

- November 2024: Shore Capital Partners and Silver Lake Management entered talks on a USD 8.6 billion merger of Southern Veterinary Partners and Mission Veterinary Partners.

- March 2024: Pet Resort Hospitality Group acquired five leading pet resort brands, marking one of the sector’s largest consolidation moves.

Global Pet Hotels Market Report Scope

The pet hotels market is defined as businesses providing specialized accommodations and care services for pets, primarily dogs and cats. These establishments offer boarding, daycare, grooming, and training, catering to pet owners seeking reliable and high-quality care during their absence, reflecting the growing humanization of pets.

The pet hotels market is segmented by type of accommodation, animal type, services offered, distribution channel, and region. By type of accommodation, the market is segmented into luxury pet hotels, standard pet hotels, and boutique pet hotels. By animal type, the market is segmented into dogs, cats, and other pets. By services offered, the market is segmented into boarding services, grooming services, training services, and daycare services. By distribution channel, the market is segmented into online, offline, and direct (phone) bookings. By region, the market is segmented into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. The report offers market size and forecasts in terms of value (USD) for all the above segments.

| By Pet Type | Dogs | ||

| Cats | |||

| Other Pets (birds, small mammals, exotics) | |||

| By Service Type | Overnight Boarding | ||

| Daycare | |||

| Grooming | |||

| Training & Behaviour | |||

| Ancillary (transport, spa, veterinary check-ups) | |||

| By Hotel Category | Luxury | ||

| Standard | |||

| Boutique / Themed | |||

| Economy / Budget | |||

| By Distribution Channel | Online Bookings | ||

| Offline / Walk-in | |||

| By Region | North America | Canada | |

| United States | |||

| Mexico | |||

| South America | Brazil | ||

| Peru | |||

| Chile | |||

| Argentina | |||

| Rest of South America | |||

| Asia-Pacific | India | ||

| China | |||

| Japan | |||

| Australia | |||

| South Korea | |||

| South East Asia | |||

| Rest of Asia-Pacific | |||

| Europe | United Kingdom | ||

| Germany | |||

| France | |||

| Spain | |||

| Italy | |||

| BENELUX | |||

| NORDICS | |||

| Rest of Europe | |||

| Middle East and Africa | United Arab Emirates | ||

| Saudi Arabia | |||

| South Africa | |||

| Nigeria | |||

| Rest of Middle East and Africa | |||

| Dogs |

| Cats |

| Other Pets (birds, small mammals, exotics) |

| Overnight Boarding |

| Daycare |

| Grooming |

| Training & Behaviour |

| Ancillary (transport, spa, veterinary check-ups) |

| Luxury |

| Standard |

| Boutique / Themed |

| Economy / Budget |

| Online Bookings |

| Offline / Walk-in |

| North America | Canada |

| United States | |

| Mexico | |

| South America | Brazil |

| Peru | |

| Chile | |

| Argentina | |

| Rest of South America | |

| Asia-Pacific | India |

| China | |

| Japan | |

| Australia | |

| South Korea | |

| South East Asia | |

| Rest of Asia-Pacific | |

| Europe | United Kingdom |

| Germany | |

| France | |

| Spain | |

| Italy | |

| BENELUX | |

| NORDICS | |

| Rest of Europe | |

| Middle East and Africa | United Arab Emirates |

| Saudi Arabia | |

| South Africa | |

| Nigeria | |

| Rest of Middle East and Africa |

Key Questions Answered in the Report

How big is the pet hotels market today?

The pet hotels market size is USD 6.00 billion in 2025 and is projected to climb to USD 8.93 billion by 2030 at an 8.29% CAGR.

Which region will grow the fastest?

Asia-Pacific leads with a 10.68% forecast CAGR, powered by rising urban pet ownership and higher disposable income.

What service segment shows the strongest momentum?

Daycare services hold the highest growth trajectory, expanding at 11.45% CAGR as owners seek daily care during work hours.

Who are the major players?

PetSmart, Camp Bow Wow, Dogtopia, Best Friends Pet Care, and K9 Resorts are the largest operators.

How are digital platforms affecting the market?

Online and mobile channels already handle more than 35% of reservations and are growing 13.12% annually, improving capacity utilisation and customer convenience.

What key challenges do operators face?

High fixed costs, labour shortages, and a complex regulatory patchwork continue to suppress margins and raise barriers for new entrants while encouraging consolidation.

Page last updated on: June 19, 2025