Polish Water Treatment Chemicals Market Analysis

The Polish Water Treatment Chemicals Market is expected to register a CAGR of greater than 4% during the forecast period.

- By the end-user industry, the electric power generation segment was expected to dominate the market. The municipal segment is expected to register the fastest CAGRduring the forecast period.

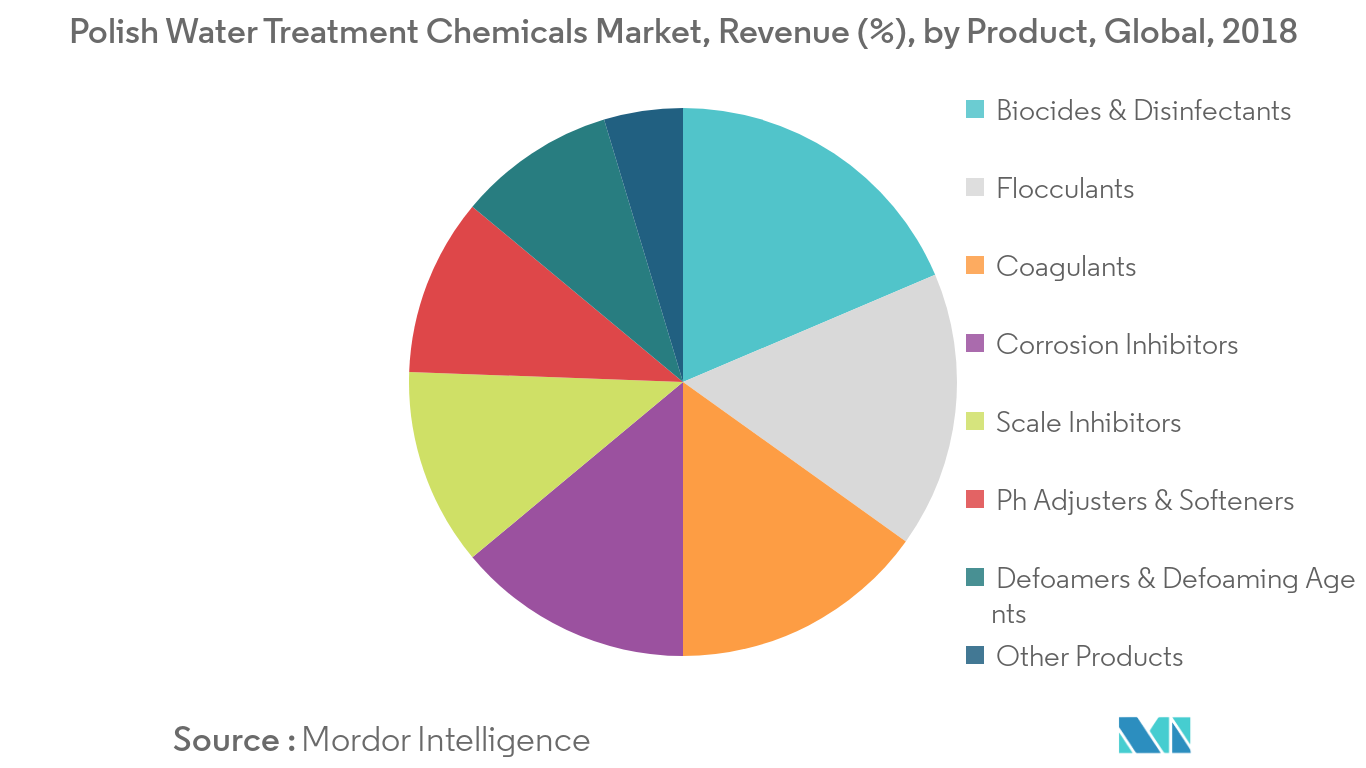

- Based on product type, the scale inhibitors segment was expected to dominate the market.

Polish Water Treatment Chemicals Market Trends

Increasing Demand for Biocides and Disinfectants

- Biocides are widely used in cooling water treatment plants. Cooling water towers are ideal locations for the growth of microorganisms, such as bacteria, algae, fungi, sulphate-reducing bacteria, and protozoa. If their growth is not controlled, they form a layer of bio-slime that acts as a natural adhesive surface for scale formation, resulting in reduced system efficiency, increased corrosion rates, and reduced water flow.

- Thus, to maintain cooling water systems at their optimum efficiency, biocides are added to the water to remove the slime, microbiological fouling, and biofilm from the cooling water systems. These chemicals are widely used in cooling towers, spas, and swimming pools.

- Biocides are also used online or as a part of a water cleaning program, in order to control biofouling in reverse osmosis membranes. These biocides are used prior to the reverse osmosis (RO) system, to regulate bio-growth in the membrane. The market has been promoting newly designed biocides like Tetrakis (hydroxymethyl) phosphonium sulfate (THPS). Unlike conventional biocides, these biocides have relatively lower toxicity, rapid breakdown in the environment, and rapid breakdown.

- In Poland, biocides and disinfectants are majorly used in municipal and chemical manufacturing (including petrochemicals) industry.

- The demand for water treatment chemicals, especially biocides and disinfectants, are expected to increase, owing to a growth in the chemical manufacturing industry and the growing demand for potable drinking water due to rapid industrialization.

- All the aforementioned factorsare expected to increase the demand for water treatment chemicals in the country.

Growing Usage in the Municipal Sector

- In recent years, in Poland, there has been a significant increase in investments in the area of municipal infrastructure. The water supply network in rural areas was dramatically extended owing to the systematic increase in rural populations.

- Desalination is a process through which the salinity of seawater is removed, and the saline water is converted to potable water. The two main desalination processes are distillation processes and membrane processes. The distillation processes include multi-stage flash evaporation (MSFE), multi-effect distillation (MED), vapor compression (VC), and multi-effect distillation-vapor compression (MED-VC). In addition, the membrane processes include reverse osmosis (RO) and electro-dialysis (ED) etc. Multi-stage flash evaporation (MSFE) covers around 50% of the total desalination process. The refined water obtained by desalination process is further treated using various techniques and the initiated of the same is taken by the municipal cooperation.

- The major applications of treatment technologies include preliminary treatment, primary and secondary treatment, tertiary treatment, biological nutrient removal (BNR), resource recovery, energy generation, etc. Moreover, municipal wastewater treatment involves much biomass. Thus, biological treatment is a major step used for the bio waste treatment.

- With the increasing investments in municipal and sanitary segments, the water treatment chemical market is expected to grow consistently during the forecast period

Polish Water Treatment Chemicals Industry Overview

The market for Poland's water treatment chemicals is consolidated. The major companies include BASF SE, Suez, Ecolab, Kemira, and Lonza, among others.

Polish Water Treatment Chemicals Market Leaders

-

SUEZ

-

Lonza

-

Ecolab

-

BASF SE

-

Kemira

- *Disclaimer: Major Players sorted in no particular order

Polish Water Treatment Chemicals Industry Segmentation

The Polish water treatment chemicals market report includes:

| Product | Flocculants | Natural | ||

| Artificial | Organic | |||

| Inorganic | ||||

| Coagulants | ||||

| Biocides and Disinfectants | ||||

| Defoamer and Defoaming Agents | ||||

| pH Adjuster and Softeners | ||||

| Corrosion Inhibitors | ||||

| Scale Inhibitors | ||||

| Other Products | ||||

| End-user Industry | Power | |||

| Oil and Gas | ||||

| Chemical Manufacturing (including Petrochemicals) | ||||

| Mining & Mineral Processing | ||||

| Municipal | ||||

| Food and Beverage | ||||

| Pulp and Paper | ||||

| Other End-user Industries (includes Textiles, Institutions, and Commercial Sectors) | ||||

| Flocculants | Natural | ||

| Artificial | Organic | ||

| Inorganic | |||

| Coagulants | |||

| Biocides and Disinfectants | |||

| Defoamer and Defoaming Agents | |||

| pH Adjuster and Softeners | |||

| Corrosion Inhibitors | |||

| Scale Inhibitors | |||

| Other Products | |||

| Power |

| Oil and Gas |

| Chemical Manufacturing (including Petrochemicals) |

| Mining & Mineral Processing |

| Municipal |

| Food and Beverage |

| Pulp and Paper |

| Other End-user Industries (includes Textiles, Institutions, and Commercial Sectors) |

Polish Water Treatment Chemicals Market Research FAQs

What is the current Polish Water Treatment Chemicals Market size?

The Polish Water Treatment Chemicals Market is projected to register a CAGR of greater than 4% during the forecast period (2025-2030)

Who are the key players in Polish Water Treatment Chemicals Market?

SUEZ, Lonza, Ecolab, BASF SE and Kemira are the major companies operating in the Polish Water Treatment Chemicals Market.

What years does this Polish Water Treatment Chemicals Market cover?

The report covers the Polish Water Treatment Chemicals Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Polish Water Treatment Chemicals Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Page last updated on: June 9, 2023

Polish Water Treatment Chemicals Industry Report

Statistics for the 2025 Polish Water Treatment Chemicals market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Polish Water Treatment Chemicals analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.